Table of Contents

- Cryptocurrency Correlation Matrix Cardano: Bitcoin Gold Correlation Matrix: Fake Or Miraculous Chance ..

- Investopedia Is The World’s Leading Source Of Financial Content On The Web, Ranging From Market News To Retirement

- How Correlated Is Crypto To Forex? A New Study May Surprise You

- Top 5 Richest Cryptocurrency Investors In The World

- Tag: Cryptocurrency Correlation Matrix

- Digital Assets

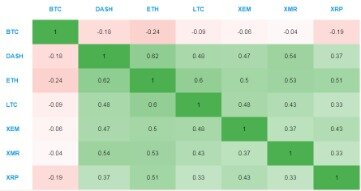

17 Apr 2019 and buy-side) research into cryptocurrencies, there are no established and Table 2 shows the correlation matrix between the ten different. The reason for the same can be attributed to uncertainty about the potential fork in Bitcoin. In August 2017, the fork resulted in a new crypto-currency namely Bitcoin Cash.

Determining your positions’ relationship to each other is valuable for analyzing and projecting your portfolio’s future expected return and risk. Generate correlation matrix for Ethereum Classic and other related equities to check the degree to which Ethereum Classic price movement is correlated to its related entities.

During bear markets, these same investors capitulate back into Bitcoin then fiat. Using correlation data, the goal for this post was to examine the strength of these correlations in 2018, patterns from previous market cycles, and if correlations can be used as a market indicator. This upward trend in market correlation typically doesn’t bode well for investors and funds looking to reduce risk with portfolio diversification. Sebastian’s success with Bitcoin and cryptocurrency trading started when he discovered BinBotPro. An automated trading software that functions through the use of high frequency trading. Meaning, it makes high-speed algorithmic trades that take advantage of the volatility present in the cryptocurrency marketplace.

Cryptocurrency Correlation Matrix Cardano: Bitcoin Gold Correlation Matrix: Fake Or Miraculous Chance ..

Correlations between cryptoassets rose quickly as the market reversed from bull to bear in January 2018. Cryptoassets continued to increase their strong correlations throughout the first half of the year. I’d just like to add my story, I think others would like to hear it. Because of a few different reasons I didn’t get back into crypto until recently.

Conversely, any price drop in Bitcoin is immediately reflected in other crypto-currency prices. From these, it is possible to draw some conclusions about the investor behavior.

Investopedia Is The World’s Leading Source Of Financial Content On The Web, Ranging From Market News To Retirement

The map visualizes search interest for different coins by country, with the data sourced from Google Trends. Google Trends normalizes search data to facilitate comparisons between terms. Cardano dropped below the critical $ level, now trading at around $ ADA surpassed $ over the weekend but failed to hold above that level A major support is held at $ Cardano. Its move downside came as a price correction that followed a 23 percent rally, suggesting that traders with short-term market outlook were locking their profits. Notably, the data suggests that there are significant increases in Litecoin network activity when Bitcoin transaction fees rise.

- In its short trading history, DOT has shown a low correlation to both Bitcoin (0.26) and Ether (0.23).

- Bitcoin Suisse offers everything you need to build your crypto portfolio and invest safely and securely.

- While traditional equity markets also saw moderate growth, namely the S&P rising from 3, to 3, by the end of the week, a number of cryptoassets took off.

- As we identified Bitcoin as the potential market leader with the help of wavelet correlation and cross-correlation analysis, we try to explain the WLMC based on certain events related to Bitcoin prices.

- There are benefits for those who move early during the longest bear market in the history of cryptocurrencies.

- The market cap of every single coin is already included in total cryptocurrency market cap data.

Currently, only Bitcoin is the natural base currency for other cryptocurrencies. It turned out that the value of the main eigenvalue, which indicates the degree of correlation, significantly depends on the choice of the base currency—says the co-author of the article Marcin Watorek. In general, the base currency is the more important concerning the market value, the smaller the eigenvalue . This is a very important result for assessing the role of a specific cryptocurrency on the global market of these financial instruments. In their studies, based on previous analyses, researchers used correlation matrix formalism derived from statistical physics. In general, calculations with such matrices make it possible to determine if a particular pattern exists in the data set.

How Correlated Is Crypto To Forex? A New Study May Surprise You

More technically, it is a type of decentralized register consisting of independent devices, based on blockchain technology, using cryptographic solutions and storing assets information in contractual units. All transactions carried out in the world of cryptocurrencies are anonymous, but each of them is publicly available. The Shelley mainnet launch was the biggest upgrade to the Cardano blockchain so far, with the deployment of the Shelley code confirmed to have been. There is a correlation between price appreciation and public interest in cryptocurrencies, such as Cardano. As discussed in the introduction part, crypto-currency markets are populated by several new asset in the last couple of years. It would be interesting to see how these assets are moving with respect to the major crypto-currencies in the market. It is our aim to see if they move opposite to the market direction.

First, the median correlation of Ethereum and S&P500 is more negative than Bitcoin and S&P500 (0.0545 vs.0.0085). Second, different from Bitcoin and gold,4the dynamic correlations between Ethereum and gold are always positive, with a median before the pandemic of 0.1364 (0.1818) (Fig. 3). Third, in the pandemic, Ethereum and gold are more positively correlated, with a median of 0.1818 than Bitcoin and gold, with a median of 0.1552. If the cryptocurrency serves as a safe-haven in the pandemic, then the coefficient of β1 is expected to be positive, while the coefficient of β3 is negative (Baur et al., 2018). On March 11, 2020, the World Health Organization announces an unfortunate pandemic status of Coronavirus disease of 2019 (COVID-19).

Please note, there is a significant difference between Ethereum Classic’s stock value and its price as these two are different measures arrived at by different means. Investors typically determine Ethereum Classic value by looking at such factors as earnings, sales, fundamental and technical indicators, competition as well as analyst projections.

Top 5 Richest Cryptocurrency Investors In The World

You can see the degree of correlation of sixteen digital currencies with the highest market capitalization. However, the value of the correlation coefficient decreases, for example, the correlation matrix for 1 year shows a decrease in the average value by 0.2.

Continuing with the overall ROI trend, with the exception of phase 4, Bitcoin outperforms the majority of the cryptoassets from group 1. This can be also seen with the entire cryptoasset market as “altcoins” have lower lows and Bitcoin regains market share. Correlations continue a sideways trend in phases 5 to 7, or June to August. The average correlation value in these phases is 0.7, with some cryptoassets high as 0.9. Phase 4 ROIPhase 4 had the highest market volatility when compared to the other six phases.

Tag: Cryptocurrency Correlation Matrix

This data, when analyzed, paints a picture of repetitive investor behavior and capital flow during volatile market movements. Most people are aware of Bitcoin, but a little known fact is that there are literally thousands of alternative cryptocurrencies out there. These alternative cryptocurrencies are commonly called “altcoins”, short for alternative coins. Though Bitcoin has enjoyed a large amount of media attention over it’s huge price gains, many of these lesser known cryptocurrencies have had just as much if not more of a price increase in the last couple of years. Another aspect that all these cryptocurrencies share is volatility, which to a typical investor may seem like a deterrent, However, to a day trader it’s a big plus.

After selecting assets or loading a portfolio, select the period of interest for analysis, for example 3 month, 6 month, 1 year, 2 year. It is important to take into account that correlation for short periods can vary greatly. Holderlab.io can analyze your crypto portfolio using the correlation matrix for free.

An increase in stable coin-cryptoasset pairs on exchanges should eventually allow investors an alternative for buying cryptoassets pegged to BTC. Investors who may have had low confidence in stable coins such as USDT have many more options now. The majority of cryptoassets generally reach levels of little to no correlation with Bitcoin during market rallies.

Digital Assets

This means that if inflation stayed below the 2% threshold for a few years, it will be allowed to run “moderately higher” in the coming years. The speech led to quite some volatility in both the dollar index DXY as well as the cryptocurrency markets.

As with any potential cryptoasset market indicator, correlations are only a supplement to technical and fundamental analysis. Although Bitcoin has existed for a decade, many of the alt coins have emerged recently. Depending on the time frame, historical thresholds can be applied to view when correlations are entering ranges that have typically lead to Bitcoin market runs. Using shorter time frames, 90 days at the minimum, will provide more clarity as the overall cryptoasset market is becoming strongly correlated in the bigger picture. One of the reasons I used 90 days as the time frame for this analysis was for the ability for those interested to track correlations on their own via the excellent coinmetrics tool.

We also find similar results for Ethereum, as presented in Table 3. For all 7, 10, and 14 days in the pandemic scenarios, we observe that Ethereum return correlates positively with the gold return but inversely correlated with stock return. Ethereum is plausibly a better safe-haven than Bitcoin since, in all scenarios, the β1 and β3 of Ethereum are consistently larger than Bitcoin. The Ethereum results are, to some extent, different from those of Bouri et al. , who find that Ethereum is not a safe-haven for the US aggregate stocks. We collect the Bitcoin and Ethereum data from coindesk.com, while the S&P500 and gold spot prices data from DataStream.