The purpose of this website is solely to display information regarding the products and services available on the Crypto.com App. It is not intended to offer access to any of such products and services. You may obtain access to such products and services on the Crypto.com App.

If you want to transfer cryptocurrency to a bank account, you’ll need to use a conversion platform. Other options include selling cryptocurrency privately for cash or using cryptocurrency ATMs and debit cards. The answer to this question is not an either or, everyone should in fact have a bank account and a cryptocurrency wallet.

Blockchain technology is one of the most groundbreaking financial innovations that promises to reduce fraud and ensure quick and secure transactions. The money will arrive in your bank account in three to five days. You also will receive a message once the money is deposited into your account. There are many different ways to turn your Bitcoin or any other crypto into fiat currencies and send it to your bank account. Some ways are more costly, some faster, some a bit of a hassle. But the good news is that it is becoming more and more easier to do so.

How long does it take for my money to arrive in my bank account?

However, rest assured that our editorial content and opinions remain unbiased and independent. These affiliate earnings support the maintenance and operation of this website. Tap on your USD balance and “Withdraw USD.” Select “Add Bank Account” or simply choose your preferred bank if it has already been linked to your Crypto.com account.

Both ways are totally fine and there’s pros and cons to each as in any business. Additionally, this website may earn affiliate fees from advertising and links. We may receive a commission if you make a purchase or take action through these links.

If transacting with someone you do not know, make sure to use a third-party escrow service. This normally comes with a higher fee than exchanges or crypto to fiat providers though. Coinmetro does not currently offer peer-to-peer transactions. So, in this sense you would be saving on fees using as few middlemen as possible.

How to Withdraw Crypto from Crypto.com

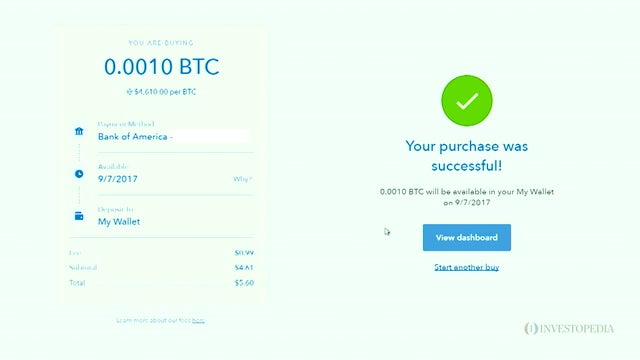

This is the most common method to withdraw crypto to a bank account, given that banks do not do the exchange rate from currencies such as Bitcoin to USD directly. After setting up your bank account, the confirmation screen will appear. First, review all the USD withdrawal information, then tap “Confirm” to proceed with the transfer. After that, the app will update the withdrawal request’s status. A confirmation window will display your crypto’s current value in fiat currency for about 15 seconds.

Bank accounts are in fact almost necessary to transferring money into the crypto ecosystem. For example, a bank account is generally needed in order to transfer money to a crypto exchange, from which then a person can transfer their crypto to a crypto wallet. Though cryptocurrency wallets differ vastly from bank accounts, they’re similar in small ways.

The daily and weekly withdrawal limits on Crypto.com depend on the level of your account verification and whether you are withdrawing crypto or fiat money. You can check the specific limits within the app or on the Crypto.com website. Crypto.com is a cryptocurrency exchange platform and a trustworthy one. It has been around since 2016, and it has more than 90 cryptocurrencies available for U.S. traders, and more than 60 fiat currencies. You can transfer crypto internationally, but if you want to deposit crypto into an international bank account, you’ll need to convert it to the accepted currency first. Crypto.com will authenticate your bank account after you’ve finished linking it to the app.

How to Deposit Crypto Into Your Bank Account

We’re not quite there yet to send actual Bitcoin to our bank accounts. Depending on the route you’re choosing, you may incur fees. If you are having to use numerous services to cash out your cryptocurrency, each can charge a separate fee, which tends to add up. You may also face blockchain transaction costs if shifting crypto from one wallet to another. While it may be tempting to jump straight in without doing any research, it’s important to make sure you understand everything involved. Navigating the world of cryptocurrency can be complicated; having solid knowledge about the entire process will save you from potential missteps down the road.

No, Crypto.com currently does not have fees for processing USD withdrawals from the Crypto.com app to your bank account. Crypto.com is also an excellent choice for more experienced traders. Though it’s not the most complicated crypto exchange platform, it can still be a bit intimidating, especially at first, because of its website.

Once you’ve converted the funds, you can make a traditional ACH bank transfer to your chosen banking institution. Crypto wallets and bank accounts are not fully interoperable. Thus, it’s difficult to have direct cryptocurrency wallet to bank account linkages. This is because cryptocurrency wallets haven’t yet partnered and collaborated with traditional banks.

Are there fees for depositing crypto into a bank account?

Pay close attention to that window, which shows the amount of fiat money you will receive in exchange for the crypto. After confirming, just enter your passcode for your Crypto.com app. You are not required to convert all your crypto funds, but you will be required to convert a certain minimum amount to transfer into your bank account. The minimum withdrawal amount on Crypto.com is $100 for each request.

You can use this article as a reference for the complete list of cryptocurrencies you can sell, but you may also refer to the app’s Trade Menu. If you have not yet set up your bank account, you can link it by selecting your preferred bank and logging in with your online banking credentials. The bank account will be accessible for withdrawal once it has been added successfully. Be sure to select the fiat wallet section instead of the crypto wallet. Then, you can input the amount you want to convert on the Fiat Wallet window.

- Depending on the exchange used, you may be able to transfer directly from the exchange to your bank account once the cryptocurrency is sold.

- We’re not quite there yet to send actual Bitcoin to our bank accounts.

- We aren’t quite there yet in terms of being able to transfer crypto to bank accounts.

- For instance, SEPA and SWIFT transfers can have different fees.

In fact something like buying food from your local store with Bitcoin is a reality rather than what ten or even five years ago seemed like a far off “some day” dream. You can use other methods for converting Bitcoin to cash and transferring it to a bank account. Depending on the exchange you use, there may also be a verification process you’ll need to complete. If your bank account is not linked to a New York address, it is likely that it does not allow ACH transfers.

Sometimes, with more exotic cryptos, this may not be possible. For example, if you’ve invested in a rather new crypto that is not yet listed on exchanges, you could try a peer-to-peer trade to sell it for another crypto, then turn that into cash. It is technologically absolutely possible to have a Bitcoin or crypto wallet linked to your bank account or a part of your bank account. For example, you could treat your Coinmetro account like a real bank account very soon as we continue to launch challenger banking services and acquire further licensing. Transferring Bitcoin to your bank account can be a bit of a nuisance. What we mean here is cashing out your Bitcoin and transferring the money to your bank account.

We’ll explain the process for depositing crypto into your bank account safely and securely. The traditional banking system is still profoundly rooted into our social lives. At the same time, these very banks are discovering the possibilities with blockchain technology, and finding better ways to incorporate the tech into the existing financial system. Only time will tell how blockchain evolves, but one thing is certain – cryptocurrencies have a future in global finance. However, crypto wallets don’t have the same safety net that banks do.

Today, Crypto.com announced that Instant Deposit via ACH is now available to App users in the U.S. This feature allows users to connect their bank account to their Crypto.com App, and get the funds to make crypto purchases immediately. Connect your bank account and receive funds to buy crypto immediately. One of the most likely causes for your transfer to be on hold is that your bank account name does not completely match your name on Crypto.com records. Withdrawal address whitelisting is necessary to increase the security of your funds whenever you wish to transfer to new addresses. To do it, you will have to select the TRANSFER button and then go to “Withdraw”, then “Crypto” and then “External Wallet”.

Hardships when transferring crypto-to-fiat

Crypto.com is popular because it is a great choice for traders who are more experienced. The exchange is not the hardest one to use, but it can be a bit overwhelming at first due to the website. Furthermore, it is known to be a quite cheap alternative compared to other crypto exchange platforms. While FDIC insurance might not cover theft and fraud, banks do. There are many ways in which banks work towards protecting customers against fraud.