Whichever platform you choose, you will be required to register an account with that platform. For example, to begin earning interest with the Hi.com platform, you need to sign up with your email address and a password of choice. Some may not even charge staking fees, hence perfect, especially for beginners. However, you should also remember that in most cases, wallets support a small variety of staking coins. “With the lack of regulation in the space, it is difficult to quantify the risks involved in lending your crypto out via these third parties,” Ashmore says.

When covering investment and personal finance stories, we aim to inform our readers rather than recommend specific financial product or asset classes. He is also a staff writer at Benzinga, where he has reported on breaking financial market news and analyst commentary related to popular stocks since 2014. Mr. Duggan is also the author of the book “Beating Wall Street With Common Sense” and has contributed news and analysis to U.S. News & World Report, Seeking Alpha, InvestorPlace.com and The Motley Fool. Mr. Duggan is a graduate of the Massachusetts Institute of Technology and resides in Biloxi, Mississippi. EToro has a grace period of between 7-10 days, which is when the investment will start earning interest.

- It also caters to upcoming and new cryptocurrencies, making most investors excited about it.

- The lending service is licensed, regulated and insured up to $100 Million against theft with BitGo and is available in 40+ fiat currencies and across 200 jurisdictions worldwide.

- Hodlnaut is a financial platform based in Singapore that offers financial services to individual investors who want to grow their crypto investments.

- Investors can stake crypto through a crypto exchange or their crypto wallets.

- This method will see investors lend tokens to a crypto exchange for liquidity purposes.

This is a heavily regulated platform with several tier-one licenses. EToro does not require investors to opt-in to its staking program, as rewards are automatically generated after 7-10 days. In this section, let’s explore the most popular ways to earn interest on crypto.

Yield Farming

Oftentimes, tax authorities require investors to declare crypto interest amounts based on the value when received. Consider that some crypto interest platforms make daily or weekly payments. In particular, when the value of the two tokens diverts from one another, this can result in impermanent loss. We review five top-rated places, each offering a different way to earn interest on Bitcoin and other digital tokens. While their high-interest rates can entice you, you should consider how secure your investment is with them. Choosing the best crypto interest account is not simply a matter of comparing interest rates paid but also making sure your investment is as safe as possible.

This makes eToro a great option for investors that want to earn interest on crypto passively. Investors will earn between 75% and 90% of the staking rewards generated by eToro. This will depend on the investor’s account tier, running from bronze to platinum. This enables investors to withdraw their coins from the staking pool at any given time. In short, APY includes a compound interest — i.e., the addition of interest to the principal sum of a loan or deposit (the interest on interest accrued). Due to the compound interest factor, APY will provide a higher return than APR.

Dan Ashmore, cryptocurrency data analyst at CoinJournal, says many crypto lenders have acted more like high-risk hedge funds than banks by gambling with their deposits. Gemini, KuCoin, Kraken and Coinbase (COIN) are among some of the most popular crypto exchanges for staking. Oftentimes, cryptocurrencies with a small market capitalization will pay the highest interest rates, as this is reflected in the risk. Not only will investors generate passive income but they will still benefit if the crypto increases in value.

Investors with smaller amounts of cryptocurrency are likely to find better yields outside of Crypto.com. Earning interest on your cryptocurrency is a great way to grow your investment. Many platforms let you take out your balance at any time, so it’s relatively easy to get out of your cryptocurrency holdings if need be. Although the interest rates fluctuate based on the supply and demand in the market, most larger coins have relatively stable annual percentage rates (APR). Savings accounts may vary in the interest they offer; hence, it is important to research to find the best account with the highest return.

What are the investment strategies for earning crypto interest?

This includes Bitcoin, Ethereum, Cardano, Polygon, Polkadot, Solana, and Fantom. We also like that Crypto.com supports stablecoins, including Tether, Dai, Pax Dollar, and USD Coin. Cryptocurrency is a work in progress and will likely undergo continuous changes over the years, especially in terms of regulation, which will also affect how crypto savings accounts are managed. Crypto lending is a great way to earn passive income on your crypto holdings. Platforms like Aave, Compound, and NEXO allow you to lend your crypto to others in exchange for interest. Lending platforms typically use a system of smart contracts to automate the lending process.

These are the biggest differences that you’ll want to be aware of. The platform pays interest on 15 traditional cryptocurrencies and 8 stablecoins. And to get the highest yields you will have to keep your investment for at least 3 months. But it also serves as a digital crypto savings account for some customers. Eligible US based customers can earn up to 4.60% APY on US Dollar Coins (USDC).

In a nutshell, the investor will deposit tokens into a crypto interest account and earn a yield. Savings accounts are usually offered by crypto exchanges, including Crypto.com, OKX, and Binance. A popular way to earn passive Bitcoin is via interest accounts and lending platforms using decentralized finance services or commonly known as DeFi. Often with crypto savings accounts, when you deposit coins, you give up access to your keys.

You should also take into account which cryptocurrency you’ll be earning interest on, so you can compare the rates between different platforms. Therefore, an investor will first compare the interest rates of different cryptocurrencies and their platforms. You can see the interest rates you will earn on different cryptocurrencies directly on their websites on the respective platforms. Some tokens may offer a very high-interest rate but present higher risks. Therefore, you should do some research before deciding which coin to stake. As a reward for helping in maintaining the network, the investors receive interest.

Pros and Cons of Earning Interest in Crypto

The option to deposit crypto back to Coinrabbit to obtain a loan is a good investment vehicle to never sell crypto. Ledn is a crypto-lending platform that brands itself as a crypto savings account. It has a few different options for earning interest on your cryptocurrency, and it has some promising rates. Besides the decent interest rates, Hi.com also offer other services that can help investors looking to deposit their funds for interest. It has an exchange platform that allows users to buy tokens using fiat currency.

- This means that investors can earn interest on thousands of different cryptos.

- Some platforms like Nexo and Youholder offer high-yield savings accounts for crypto.

- The platform is able to offer higher rates by lending the assets to established and vetted financial institutions that pay an interest rate to hold those assets.

- Gemini provides the flexibility to move the crypto assets to the trading platform (with interest) and vice versa.

If you believe Bitcoin is an established store of value, it may not be a bad idea to diversify some of your holdings into crypto. Cryptocurrency investment can be risky, especially if you are a beginner. You have to grapple with the volatility of the market, legal issues, and even fraud.

HedgewithCrypto has conducted an assessment of the top savings accounts to earn interest in this comparison table. The comparison takes into account important factors such as ease of use, reputation, supported currencies, crypto interest rates, pay-out frequency, fees, security and customer support. These services allow you to earn interest on Bitcoin and crypto without having to trade the markets using an exchange.

Crypto Savings Accounts Vs. Regular Savings Accounts

If you aren’t looking to hold crypto for the short term, then you’ll want to use a platform with no minimum lock up requirements on their savings accounts. If you’re a long-term oriented cryptocurrency investor, then you should certainly consider earning interest on your digital assets. Using cryptocurrency to earn interest will provide you with passive income, and it will compound your profits if the cryptocurrency markets continue to appreciate. Staking done on the Coinbase website will require you to lock up your crypto tokens for a certain period. Some of the supported cryptocurrencies for staking include Ethereum, which yields 4%, Tezos (4.645%), DAI (2%), Algorand (4%), and USD (0.15%) are supported at Coinbase to stake.

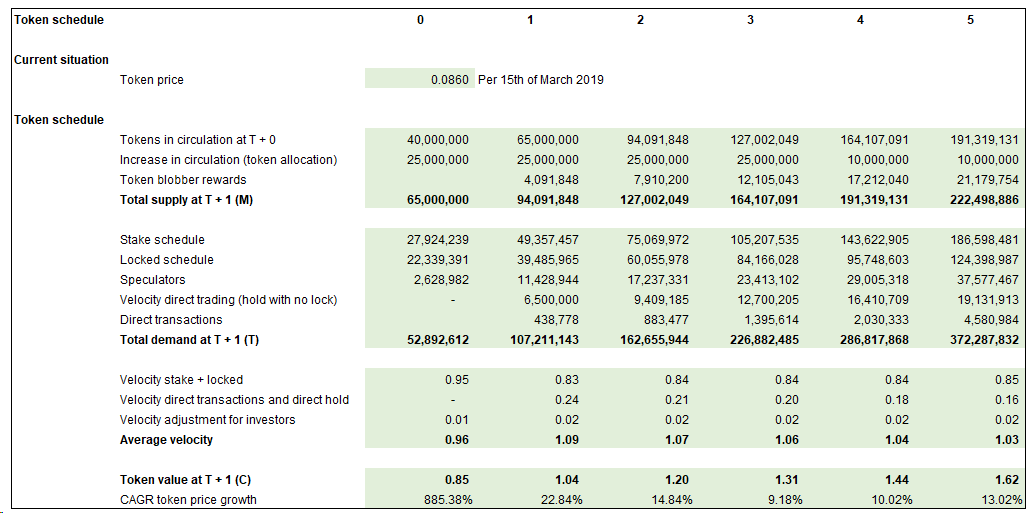

In this instance, the exchange might charge borrowers an APR of 13% – pocketing the 3% difference. For example, there are many different ways to earn crypto interest – and this includes staking alongside savings accounts and yield farming. The amount of interest that can be earned on crypto will depend on many different factors.

Compounding Growth

Such interests may vary continuously based on the demand and supply for crypto loans. This qualifies the fact that investments in cryptocurrency are very volatile. Finally, we come to the easiest option, which is a cryptocurrency savings account. A Crypto savings account is provided by centralized companies, which agree to pay users interest for holding their tokens on their platforms. The company can use the deposit in various ways, including lending it out to generate interest.

Nexo and Crypto.com are among companies offering greater interest rates to cryptocurrency holders who lock their assets away for weeks or months. However, the drawback with this type of savings account is that you can’t withdraw or sell your crypto during that period. Primarily, it will be used for lending it out to earn high returns, some of which will be paid to you as regular interest payments. Crypto interest platforms are a popular way to earn additional income. Lending platforms can offer attractive interest rates as high as 12% APY on crypto, which is significantly higher than a traditional bank.