The company charges a $10 activation fee as well as a monthly administrative fee of just $5, which is waived if the cardholder spends more than $750 per month in non-cash transactions. BlockCard charges no deposit, exchange, or withdrawal fees and just $3 for domestic ATM cash withdrawals ($3.50 international). Bitcoin debit cards let individuals make online or in-person purchases or withdraw cash from ATMs using Bitcoin, even if the vendors and ATMs don’t accept cryptocurrency. Instead of exchanging Bitcoins into local currencies, cardholders preload their debit card with a set amount of cryptocurrency, which is then automatically converted at the time of purchase.

These include cashback of up to 8%, free ATM withdrawals, and the ability to earn interest on fiat, BTC, and ETH currencies. However, maximizing your cashback requires a user to hold BNB; there is a sliding scale ranging for .1% cashback for someone with 0 BNB to 8% for someone with 600+ BNB. Binance card fees are very reasonable—just a .9% commission fee on transactions. And Europe must pay a £4.95 or 4.95 € issuance fee for a Coinbase Card, while U.S. residents can get the card for free.

Best for Cashback

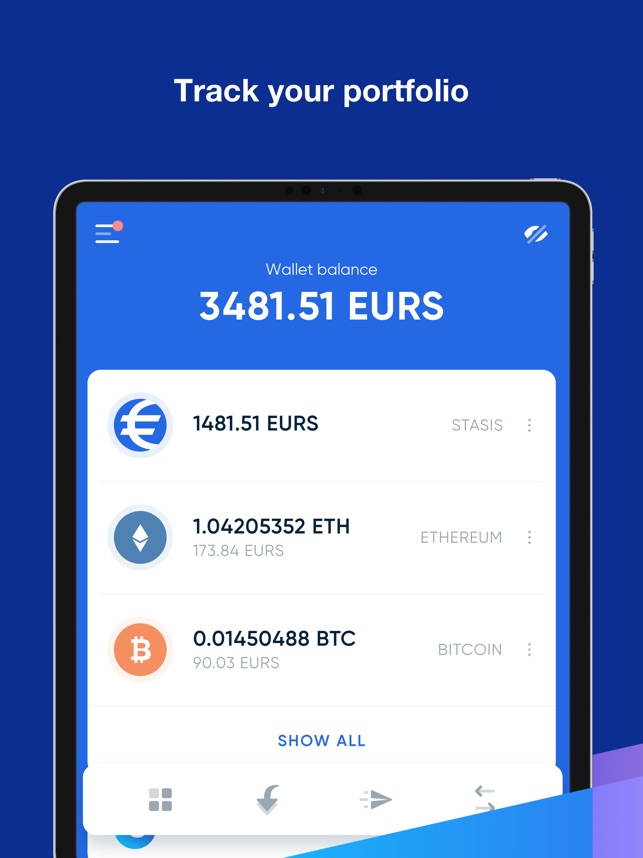

Like regular debit cards, these allow you to spend money from an account by swiping your card (or entering the numbers from it). The big difference is that instead of this card linking to your bank account, it connects to one of your crypto wallets. The best Bitcoin debit cards charge few fees and include perks like cash back rewards and mobile apps. They should also support multiple types of cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin. Bitcoin debit cards should come with robust security features to help protect your funds. A crypto debit card is much like your regular debit card, but instead of being connected to your bank account, it’s tied to a digital wallet that contains your cryptocurrency.

While offering such apps is becoming standard, not all allow for as much functionality is the BitPay app. The Coinbase VISA card links directly to your Coinbase wallets, which means you won’t have to preload crypto like you would on most crypto debit cards. Additionally, it allows you to earn back crypto rewards; 1% back on most transactions and 4% back on transactions made with Stellar Lumens. However, although it doesn’t charge an annual fee, the Coinbase card does charge a 2.49% cryptocurrency liquidation fee on every purchase, which could add up over time.

To reach these final five, a variety of crypto debit cards were considered side by side. The BitPay Card offers an excellent entry into the crypto debit card lifestyle. While this card doesn’t have a rewards program, it excels in most other aspects of these crypto cards. There are thirteen cryptocurrencies supported and no conversion fees for making purchases or ATM withdrawals (ATMs do include a separate fee). The BitPay companion app makes it easy to freeze your card if you’ve lost it or pay without it if you left it at home.

Binance

Not only does this card offer high rewards to serious investors, but there are little to no fees for many transactions. The company offers different tiers of cards that each require an additional amount of staked CRO in USD value. The tiers differ in some aspects beyond rewards, including a transaction threshold for each level. Transactions under your card’s threshold don’t incur a transaction fee, while those that go over have a 0.5% fee.

BlockFi also offers a bunch of other nice bonuses, including 0.25% back in Bitcoin on eligible trades (up to a maximum of $500 each month) and $10 in Bitcoin for every client referral. Monolith, built on the ETH chain, is the only DeFi platform on this list—there’s no custodian involved.. Notably, it supports ETH and any other ERC-20 token, giving altcoin holders a lot to be excited about. Box, and applicants need to provide a driver’s license and Social Security number. BlockFI Interest Accounts (BIAs) are no longer offered to new clients who are U.S. persons or persons located in the United States.

Users earn points with every purchase, which are converted at the end of the month into a crypto asset of the cardholder’s choice (selected from available coins). Depending on that month’s market movements, this approach can be a boon or a hindrance for cardholders. For crypto investors who enjoy the volatile price swings of the crypto market, this card can offer another angle to appreciate and potentially benefit from those fluctuations. Security was also important, and we made sure to choose cards that offer the same level of security as traditional debit and credit cards as well as quick ways to freeze or cancel a card.

Nuri also charges no monthly, ATM, or withdrawal fees, although some operators may charge ATM fees. BitPay is our top pick for cryptocurrency enthusiasts living in the U.S. The card features no exchange fees in the U.S. and can be used anywhere MasterCard is accepted. Coinbase has stated that they’ve removed transaction fees, making this a potentially fee-less process.

Where Can I Use a Bitcoin Debit Card?

It has cashback rewards on an unlimited volume of purchases, with rates capping out at 6%. To earn rewards, however, you need to stake TRN (Ternio); with the highest rates requiring a user to stake 145,000+ TRN. An additional perk of BlockCard is its ability to be used with Apple Pay, Google Pay, and Samsung Pay. The Coinbase Visa card won our top spot as the best crypto debit card, although the competition was fierce, and each of these cards has plenty to offer.

Crypto.com has the sole discretion to modify the private members benefits and/or welcome offers at any time. Although the Binance Visa Card’s cashback rate is the highest rate we’ve come across, it comes with a catch. Cardholders must have a balance of 600 Binance Coins, known as BNB, and receive their cashback reward in BNB.

Best Variety of Cryptocurrencies Supported

In 2020, the company partnered with Swipe to offer a Visa debit card that offers 8% cashback, making it our choice as the best for cashback. Depending on what you want to get from your crypto debit card, different cards might be best for you. There is some overlap in best use cases between some of these cards, and in those cases, the best one for you may come down to more nuanced differences. For instance, both Binance and Crypto.com offer up to 8% cashback on their cards, but they have different requirements for reaching this reward level. The Crypto.com Visa Card offers more benefits the larger the sum you have staked in CRO.

- It features support for 80+ cryptocurrencies and over 20 fiat currencies.

- While crypto cards let you spend your crypto with ease, there are some downsides.

- In order to buy each of the Crypto.com cards, cardholders must stake an amount of the company’s native CRO tokens (formerly MCO).

- Instead of drawing on cardholders’ Bitcoin holdings, the card offers 1.5% cash back per purchase in Bitcoin with bonus Bitcoin rewards making it our choice as the best for cashback.

- While the five reviewed above are our top picks, there are many others to consider.

This site does not include all financial companies or all available financial offers. Our editors thoroughly review and fact-check every article to ensure that our content meets the highest standards. If we have made an error or published misleading information, we will correct or clarify the article. If you see inaccuracies in our content, please report the mistake via this form. The purpose of this website is solely to display information regarding the products and services available on the Crypto.com App. It is not intended to offer access to any of such products and services.

No matter your tier, this card is usable at merchants and ATMs both, making it a viable everyday debit card. It was founded in 2011, well before cryptocurrency had expanded into the vast sphere of coins it is today. The company’s history and experience have lent towards making a crypto debit card with minimal costs, impressive ease of access and utility, and strong security. While rewards would be a nice caveat, the lack thereof doesn’t keep the BitPay Mastercard from being runner up for best overall on our review list. The company’s background and experience have also lent a great deal of security to its card.

Although mainstream adoption of cryptocurrencies is still on the horizon, it has grown significantly closer. There are now numerous crypto debit and credit cards to consider, whereas only a few years ago, these options barely existed. While the five reviewed above are our top picks, there are many others to consider. Three more crypto debit cards that may interest readers you are the Gemini Card, the Wirex Card, and the Nuri Card.

And we pore over customer reviews to find out what matters to real people who already own and use the products and services we’re assessing. Cardholders cannot load cryptocurrency onto their Crypto.com Visa Card. All cryptocurrency will be converted to the respective market’s currency and can be loaded onto the Crypto.com Visa Card for use in purchase and ATM withdrawals. In order to buy each of the Crypto.com cards, cardholders must stake an amount of the company’s native CRO tokens (formerly MCO). BlockFi is a good choice for customers looking for a Bitcoin credit card with a generous 1.5% cash back, with 2% after $30,000 of yearly spending. Coinbase is one of the more prominent names in crypto, with it being one of the largest exchanges and the first to claim a spot on the New York stock exchange.