Table of Contents

- Trading Based On Multiples Of Volatility (mov)

- How To Use Forex Volatility Statistics

- Best Hours Of The Day To Day Trade The Eur

- How To Trade Forex In A Slow Market (low Volatility Trading)

- (tvix) Velocityshares Daily 2x Vix Short

Ivolatility.com, offers a forex volatility chart which can help you determine the relative level of implied volatility. The free version shows currency ETF implied fx volatility index for 52-weeks, and is helpful in determining the relatively strength of present implied volatility. A simple options calculator will allow you to input a price and find the fx option volatility of a specific currency instrument. What has already happened is known as historical volatility, whereas what market participants think is going to happen is referred to as implied volatility. The former, can be used to predict the latter, but the latter is a market input, determined by the people that are participating in the forex options market. Cboe is the home of volatility trading, and the Cboe Volatility Index® (VIX® Index) is the centerpiece of Cboe’s volatility franchise, which includes VIX futures and VIX options.

If a currency is more volatile relative to the U.S. dollar, consumers may expect more price fluctuations,” he says. Why should you care about the volatility of foreign exchange rates?

Trading Based On Multiples Of Volatility (mov)

VAR also has a relatively narrow definition and does not incorporate other types of risk management challenges such a credit risk, and liquidity risk. The calculation is purely focused on market risk and could provide a false sense of security if used as a standalone measure. Of course there are drawbacks to using VAR as the only strategy to measure market risk.

First, there are many assumptions that one can use to define a VAR, which means there is no standard measure. Liquidity plays a role in defining your ability to use VAR as a risk management tool. In addition to evaluating implied volatility to determine how volatile the market could be, you can also evaluate what has happened in the past to determine future volatility. Historical volatility tells us how much the market has moved on an annualized basis. The historical volatility is calculated by defining several parameters.

A forex news calendar will pinpoint exact times to be in front of the computer in local time or GMT time clock. With this knowledge a trader can be in frot of the computer at the proper time for a potential trade and market volatility. Also, an example chart of the GBP/CHF sell off is also shown, you can see this pair alone sold off 175 pips. The GBP pairs as a whole moved much more than 1000 pips in one trading session on this day. If you need a world economic news calendar to track GBP news events we have one on our website. These handy calendars will also provide you with scheduled news drivers for other important and most actively traded currencies.

How To Use Forex Volatility Statistics

Volatility can be your best friend or your worst enemy in forex—it’s all about how you understand that volatility, and how you attempt to capitalize on these market conditions while minimizing your risk. These volatility indicators will help you get a better read on an uncertain situation, which could lead to some timely trades that turn volatility into a winning proposition.

Therefore, heightened volatility is usually seen during corrections within trends and in trend reversals. Please note that this is a snapshot in time, and these statistics will constantly change. The hours that are most volatile tend to stay the same, but how much the price moves during these hours will change. Which weekdays are most volatile also tend to stay the same, but could change over time as well. Cryptocurrencies can fluctuate widely in prices and are, therefore, not appropriate for all investors.

Best Hours Of The Day To Day Trade The Eur

It is much easier to trade when price waves are 20 pips and you are only trying to nab 12 to 15…much more room for error there. Notice that the scale on the y-axis, in Figure 2, only covers 18 pips.

- The volatility for the majors in the currency market are relatively subdued relatively to individual stocks or commodities.

- Monitor changes in volatility, especially if your strategies are sensitive to these changes.

- This huge volatility is likely to be here to stay as the economic fallout of this global pandemic plays out.

- Analysts will also publish expectations for news releases like NFP.

- This indicates that the average trading range for the currency pair has neary doubled.

- See the example below of the world economic news calendar showing some scheduled US Dollar news releases.

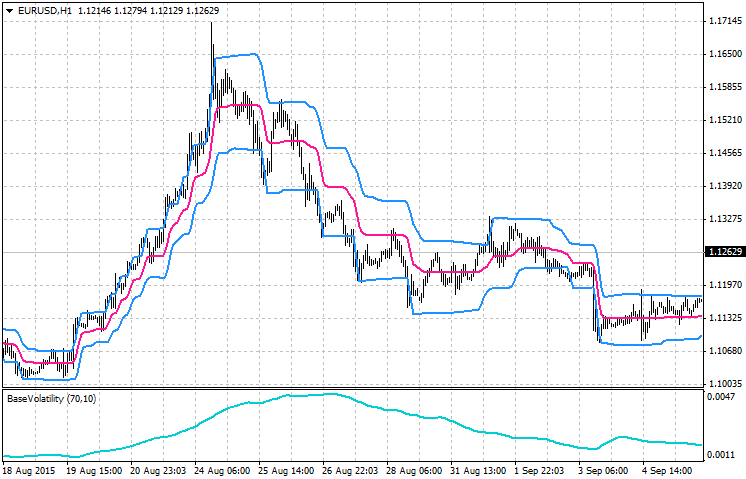

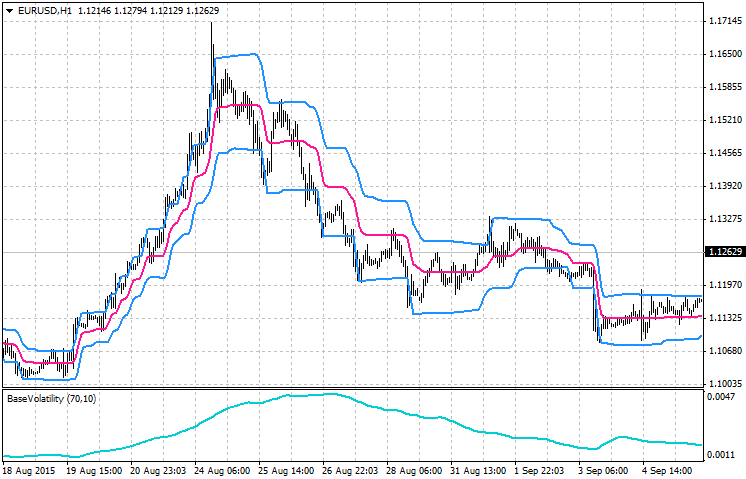

The point is, it’s important to be aware of what volatility is doing overall and intraday. We can keep track of overall volatility by referring to a historic volatility chart, like Figure 1, from time to time. Each day, we can maintain some perspective on volatility by always being aware of how many pips our y-axis is showing. I typically like to keep mine at about 60 pips or more (the exact number isn’t important, rather I just like using the same figure each day). Less than that and inconsequential moves can start to look big and inviting, when in fact they are quite small. I will also measure price waves to make sure they give me a decent margin of error for the profit target I am aiming for.

If your trades last more than a week, the daily data provided by Mataf may be overkill…you simply don’t need that much data. Apply an Average True Range indicator to your charts, and this will likely provide you with all the volatility information you need. Day traders are especially susceptible to the cost of paying the spread, and when volatility drops so does profit potential. Less volatility, and reduced profit potential, makes the spread more expensive. Therefore, short-term traders usually benefit by NOT trading when volatility is very low. This can be a confirmation or a signal the forex market is nearing a turning point (a very powerful volatility thrust after a long-term trend is called a “blow off”), but it depends of the maturity of trend.

How To Trade Forex In A Slow Market (low Volatility Trading)

Gain valuable insight when gauging sentiment in the Foreign Exchange markets. Get a summary of the latest polls results for up to 12 months, including individual contributors and statistical measurements of accuracy.

Does HotForex have volatility index?

F – Trading Details.

The output number is a percent value which tells you the annualized movement of the returns of a currency pair. The calculation determines the probability that the underlying exchange rate will be above or below a strike price, depending on whether you are generating a price for a call or a put option. One of the biggest risks to an equity portfolio is a broad market decline. The VIX Index has had a historically strong inverse relationship with the S&P 500®Index. Consequently, a long exposure to volatility may offset an adverse impact of falling stock prices. Market participants should consider the time frame and characteristics associated with VIX futures and options to determine the utility of such a hedge. The forex market moves in cycles, constantly rotating through volatile and calm periods.

The Cboe Volatility Index is one of the most widely watched gauges of market volatility. Average true range is a charting indicator that shows how wide a stock or commodity’s daily trading ranges have been over time, with high readings reflecting higher volatility. Changing the number of weeks that are averaged on the volatility study may greatly affect the data provided. If you are a short-term trader, track volatility statistics based on the last 3 weeks or less. Longer-term traders can benefit from looking at volatility averaged over the longer term .

Make sure the news calendar you choose has a look ahead calendar for planning your trading week. Click on the “this week” to see the entire week of important news drivers on one screen. This helps with planning your trading schedule if you are on a tight schedule. You can also use the look ahead schedule to see when major bank holidays are. USA bank holidays are good days to take a day off from trading or take a long weekend. In this article we will review and compare forex news calendar features that are available to traders.

Futures, futures options, and forex trading services provided by TD Ameritrade Futures & Forex LLC. Trading privileges subject to review and approval. Forex accounts are not available to residents of Ohio or Arizona. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Please read the Forex Risk Disclosureprior to trading forex products.

It is commonly used for volatility breakout entry levels andvolatility-adjusted position sizing. At 11PM EST place a straddle trade pips out from the current price on the next day’s 7PM EST expiration. I back tested this strategy for 6 months from June to Jan 2015 and found it to be an overall winner. But keep in mind this was using the 80 pip threshold and no risk management. While a spike in volatility subsided to close out 2020, it was still much higher than at the end of 2019, as can be seen in the chart below of EUR/USD 3 month implied volatility.

Trading news announcements can be risky due to the large moves that can follow a news release. Trade a wide range of forex markets plus spot metals with low pricing and excellent execution. Typically, the Bollinger Bands sit outside the Keltner Channel, but a period of consolidation can pull them in, creating a narrowing that may at first appear to indicate reducing volatility.

What is volatility 75 1s?

The Volatility 75 Index better known as VIX is an index measuring the volatility of the S&P500 stock index. VIX is a measure of fear in the markets and if the VIX reading is above 30, the market is in fear mode.

The news announcement gives out the number of paid US workers of any business, but excludes government employees, farm employees and non-profit organization employees. Volatility statistics indicate that the non farm payroll news announcement is the most volatile of all scheduled US Dollar economic news drivers. The average movement of currency pairs is higher than any other news driver, so this is why traders are interested in trading to take advantage of this. The GBP pairs are naturally more volatile, but less volatile pairs can become much more volatile after scheduled news divers, or other unexpected worldwide news events. Pairs that are less volatile become much more volatile after news events, as long as one currency is consistently strong and the other currency in the pair is consistently weak. We track 8 currencies including the GBP pairs with our indicators. Following all 28 pairs and 8 currencies is fairly easy, and when combined with our professional forex alert systems and the economic calendar, you will always be in the know when currencies are moving.

VIX futures and options have unique characteristics and behave differently than other financial-based commodity or equity products. Cboe’s Inside Volatility Newsletter brings you the latest insights on the volatility market, breaking news, and interesting trades. Despite the slow movement I am still trading the daily charts using my free price action strategy. USDCAD has been moving sideways on the daily since the start of April.