Table of Contents

- Automated Trading

- Learn To Trade

- Base Currency

- How To Trade Nzd: Correlation With Other Pairs

- What Is Currency Correlation & Why Does It Matter?

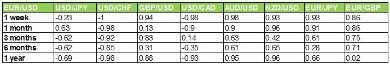

- Currencies That Are Currently Highly Correlated

- Trading

To build a strategy around correlations, you need to use these findings to your advantage. Build a portfolio of currency pairs that show no high positive or negative correlation between pairs. You can add EUR/USD, AUD/USD, and any other pairs in your portfolio, but the total portfolio should consist of variously correlated pairs so that you reduce your market risk.

In other words, when your long EUR/USD position moves up in price, your USD/CHF long will be going down by nearly the same amount, resulting in a pretty pointless trade at double the spread cost. • USD/CHF moved in the opposite direction of the EUR/USD 97.5 percent of the time. The employees of FXCM commit to acting in the clients’ best interests and represent their views without misleading, deceiving, or otherwise impairing the clients’ ability to make informed investment decisions. For more information about the FXCM’s internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms’ Managing Conflicts Policy.

Automated Trading

If the price of AUD/USD rises, you would need to sell more US dollars in order to buy a single Australian dollar – which means that the Australian dollar is strengthening compared to the US dollar. Correlation ranges from -100% to +100%, where -100% represents currencies moving in opposite directions and +100% represents currencies moving in the same direction. The correlation coefficient is a statistical measure that calculates the strength of the relationship between the relative movements of two variables. Correlation is a statistical measure of how two variables relate to one another. The greater the correlation coefficient, the more closely aligned they are. tbes.xn—-dtbwledaokk.xn--p1ai is a trading name of GAIN Capital – tbes.xn—-dtbwledaokk.xn--p1ai Canada.

A less popular regional pair would be the Swiss franc to the United States dollar, CHF/USD. During the period of January 1999 to August 2001, EUR/USD and CHF/USD had an exceptional daily positive correlation of .95. Essentially, CHF/USD and the EUR/USD moved in lockstep every day during this period. The +.95 value, coupled with the extensive period of time in which the correlation existed, is a good illustration of an extremely high positive correlation. If recognised in a timely manner, this correlation would have been very useful in the development of trading and investment strategies concerning EUR/USD and CHF/USD currency pairings. A negative correlation expresses an inverse relationship between two variables. In this case, when currency pair A experiences a price movement, currency pair B moves in the opposite direction.

Learn To Trade

Alternatively, you could open two opposite positions on two positively correlated pairs, and the gains on one would offset the losses on the other. You can use correlations to help with risk by making sure you aren’t accidently doubling up on one side of a currency trade. Use the correlations to help confirm if a breakout is real or not, and also help to manage your winning trades. Type in the correlation criteria to find the least and/or most correlated forex currencies in real time.

The two trades would effectively cancel each other out, due to the negative correlation exhibited by these two pairs. One of the most important aspects to remember regarding currency correlations is that they are constantly changing in value. As exchange rates of the currency pairs themselves fluctuate, the relationships between the pairs evolve. The correlation of a currency pair today is not necessarily the correlation of the currency pair tomorrow. With that said, there are a few currency pairs that seem to stay correlated over long periods. You’ll notice that they all involve USD – that’s probably why they stay correlated, as USD often moves in the same direction against most currencies. Looking at two negatively correlated currency pairs, when a significant upward price reversal in one pair takes place, then you can anticipate a potential downward reversal in the other pair.

Zero coefficient shows that there is no certain pattern in which the currency pairs react – they can either move in the same direction or the opposite. Simply said, currency correlation shows how much two currency pairs correlate – positively or negatively. Money management is the biggest tool in your Forex trading toolbox, correlation in Forex and money management can go hand in hand. If you trade across multiple currency pairs frequently, then you must be aware of correlations. If you are long on one currency pair and short on another, it could be that this trade is actually canceling itself out because they are both correlated the same way. Equally, if you are long and short on different pairs then you could be over leveraged on one currency pair without even realizing. Wait for an abnormal divergence between two highly correlated currency pairs and buy one and sell the other, with the expectation that they will converge in price movement again.

Base Currency

If there is a negative correlation between AUD/USD and USD/CAD, possessing a lengthy position on both the pairs will cancel each other out effectively. It happens as the pairs are predicted to proceed in opposing directions. This means whenever a currency pair moves upwards, the perfect negative correlation currency pair moves downwards – pip for pip. When a currency pair move is a perfect negative correlation, this is represented with a 0.

A reading of +80 shows there is a very strong correlation between two currency pairs–they move in the same direction very often, but not all the time. A forex correlation is how one currency pair moves in relation to another. Some pairs move in a very similar way, others move in opposite directions and other pairs may have no relation to each other at all. If you take multiple currency positions at one time, knowing how your pairs act in relation to one another is key to understanding your real risk and profit potential. It is possible that you are taking on much more risk than you think or that any gains in one pair will be erased by a loss in the other .

Typically, an increase in the price of oil will see an increase in the value of the Canadian dollar on the forex market. This is often reflected in the movements the USD/CAD pair because oil is traded in the US dollar, which is generally negatively correlated with the price of oil. As an example of the positive correlation between these two pairs, you could open two long positions on the EUR/USD and the GBP/USD currency pairs. If the correlation is currently present in the market and if the pairs increased in price, you could potentially increase your profit. This is powerful knowledge for all professional traders holding more than one currency pair in their trading accounts.

Trade your opinion of the world’s largest markets with low spreads and enhanced execution. The correlation that worked well for you a week ago may have completely disappeared this week. Because it’s quite rare to find a 100 percent correlation, but an 80 percent correlation is a number you can work with. Highlight all the data in one of the price columns that will give you a range of cells in the formula box. You can then list the time frames horizontally along the top row of the table, such as one month, three months and six months.

How To Trade Nzd: Correlation With Other Pairs

Varying the time frame of the correlation readings tends to give a more comprehensive look at the differences and similarities of the correlation between currency pairs over time. Correlations between currency pairs are inexact and depend on the ever changing fundamentals underlying each nation’s economy, central bank monetary policy, and political and social conditions. Currency correlations can strengthen, weaken or in some cases, break down almost entirely into randomness. Forex currency pairs are made up of two national currencies, which are valued in relation to one another.

On the other hand, if the coefficient leans more toward -100% or -1, then the pairs correlate on the negative side. These are the mostly traded, highly volatile and liquid currency pairs in the foreign exchange market. You will find so many profitable trading opportunities in these currency pairs, no matter which time frame you follow. So, in the above scenarios, EURUSD and GBPUSD both are positively correlated currency pairs since they both tend to move at the same direction at the same time. Basically, the closer that two currency pairs are geographically, the more likely a positive correlation between the two exists.

Challenge the Forex market by developing a profitable automated trading strategy. Become part of the community to gain new knowledge and connect with fellow traders.

Typically a correlation of -/+ 70 is significant and noteworthy, while -/+ 80 is a strong correlation . However, if you look at the entire day, you would see that the pairs were consistently positively correlated, despite a few moments within the day when they moved opposite each other. If you had worked with the data from the 5-minute correlations throughout the day, then you can see how that could have worked against you. We all know that even with the most in-depth analysis of the charts, we sometimes get it wrong and end up losing.

One thing that you can do is figure out what currencies are positively and negatively correlated and try to cushion your currency portfolio against any changes to one group of correlated currencies by diversifying. It is important to look at the charts and the Currency pair correlation indicator as often as you can, but it is also important to remember that correlation changes over time. Depending on the relationships of countries, in terms of exchange rates, their trading levels, the strength of their economies, so on and so on, things may change in terms of how two currencies might be correlated. Which is why it is important to keep track of what is going on and never double down on a decision that you are not 100% sure is correct.

One of the key takeaways from this is that if you know how currency pairs correlate you can use it as confirmation bias of the market sentiment before entering a trade. You could also make a trade on correlations of forex pair to hedge your risk within your currency trades that are active.

The Swiss franc, as expected, shows positive but not very strong positive correlations across the board. As we’ve previously stated, the Swiss franc is a safe haven and tends to be affected by other factors outside domestic macroeconomic reports. Pipbear.com is a blog website dedicated to financial markets and online trading.

This is particularly true if a country is a net exporter of a particular commodity, such as crude oil or gold. An example of a positively correlated hedge would be if you thought that EUR/USD and GBP/USD were about to break their positive correlation. This could be because the Bank of England is expected to dramatically alter interest rates, or there is economic slowdown expected in the eurozone. If this was the case, you might choose to take a temporary short position on GBP/USD to offset any losses on your long EUR/USD position. Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

Trading

You will be guided in risk management, especially if you keep track of the correlation coefficients on a daily basis, weekly basis, monthly, or yearly time frames. Currency correlations can be a strong tool one could utilize for developinga forex pair correlation strategyof high-probability.