Table of Contents

- Summary Bull And Bear Markets

- Thoughts On what Is A Bull And A Bear Market?

- Bull Vs Bear Markets

- Why Do Bull Markets Sometimes Falter And Become Bear Markets?

- When Were The Most Prolific Bull And Bear Market Periods In The United States?

You’ll still see day-to-day market swings up and down when we’re in bull or bear territory. “The stock market loses 13% in a correction on average, if it doesn’t turn into a bear market”. Ideally, investors would wish to use market timing to buy low and sell high, but they may end up buying high and selling low. Contrarian investors and traders attempt to “fade” the investors’ actions . A time when most investors are selling stocks is known as distribution, while a time when most investors are buying stocks is known as accumulation.

The Dow theory states that the market is trending upward if one of its averages advances and is accompanied by a similar advance in the other average. A bear position is a term representing a short position taken on a financial security with the expectation of a drop in price. Business News Daily was founded in 2010 as a resource for small business owners at all stages of their entrepreneurial journey.

Summary Bull And Bear Markets

Investors weighing whether to buy and sell may be wondering what is a bull vs. bear market mean and how should they respond? The overall market condition is a key factor when deciding what to do about an individual stock. Options involve risk and are not suitable for all investors. Options investors may lose the entire amount of their investment in a relatively short period of time. Indicators of confidence are prices going up, market indices like the NASDAQ go up too. Number of shares traded is also high and even the number of companies entering the stock market show that the market is confident.

Securities trading is offered through Robinhood Financial LLC. A head and shoulders pattern is a bearish indicator that appears on a chart as a set of 3 troughs and peaks, with the center peak a head above 2 shoulders. Fundamental analysis is a method of measuring a stock’s intrinsic value. Analysts who follow this method seek out companies priced below their real worth. Trend analysis is a technique used in technical analysis that attempts to predict future stock price movements based on recently observed trend data. A contra market is one that tends to move against the trend of the broad market, or has a low or negative correlation to the broader market.

Thoughts On what Is A Bull And A Bear Market?

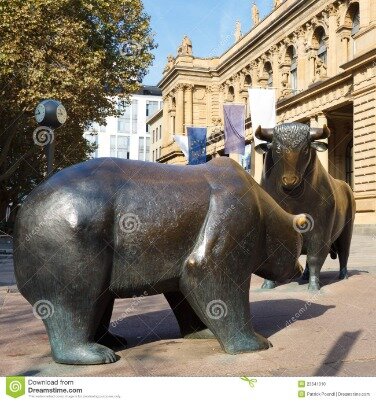

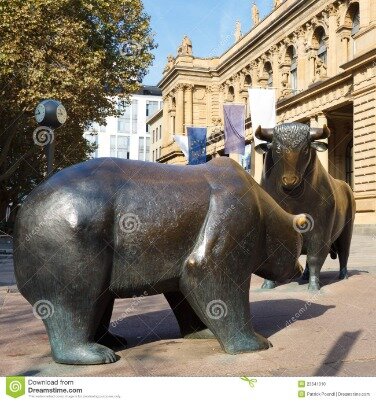

The stock market was also described as being in a secular bear market from 1929 to 1949. In a secular bull market, the prevailing trend is “bullish” or upward-moving. After all, when most stocks are gaining day after day, it’s easy to look smart. Indeed, the market has been in bull mode for so much of the last decade-plus, it’s hard to remember what challenging investing looks like. Artists helped further popularize the terms during the 19th century. Thomas Nast publishedcartoonsabout the slaughter of the bulls onWall Streetin Harper’s Weekly. In 1879, William Holbrook Beardpainted the stock market crashusing bulls and bears.

Regardless, by many strategists’ definitions, we’re in a new bull market. Indeed, from the March 23 bottom to Aug. 18’s record high, which confirmed the new bull market, the S&P 500 rose a remarkable 52%. One factor that contributed to this bear market was the decision byPresident Richard Nixonto end the gold standard, which was followed by a period of inflation.

Bull Vs Bear Markets

During this bull market there was an average market gain of nearly 600%. Post-WWII. The years during and following WWII were exemplary of a bull market as the U.S. economy prosperedwhen millions of soldiers returned home. An index enters a bear market when it falls at least 20% from a recent high. A bear market officially ends once the market hits a new closing high, like the S&P 500 did on Tuesday.

Should I buy stocks when the market is down?

Keep Investing—Especially When the Market Is Down

No one likes losing money. But it’s important to keep investing money even if the market is dropping. Historically, the stock market has always recovered its losses.

Traders would sometimes sell bearskins that they hadn’t yet purchased to keep up with demand. As a result, they’d then hope the price of bearskins would fall since they would have to buy them to satisfy the orders. That desire for a bearskin price drop led traders to earn the nickname “bears.” Every “ying” needs a “yang,” so bulls became the positive bears’ counterpart. Bull markets are typically designated by media outlets as a rise of 20% or more from a near-term low.

Why Do Bull Markets Sometimes Falter And Become Bear Markets?

Moves of this magnitude have happened about four times per year since 1980. “Bull market” and “bear market”— two terms you’ve probably heard tossed around before but may not completely understand. Whether you’re brand new or an experienced investor, it’s good to review how both market types work. So next time you hear news anchors debating, “Are we in a bull or a bear market? Financial markets go through cycles of boom and bust, highs and lows.

is an unsecured short-term instrument that financial institutions and other companies may use to raise capital. The S&P 500 more than doubled as deregulation led to mergers, acquisitions, and flurries of market activity powering corporate profits. Both periods earn the bull/bear mascot combo because they grew or fell by over 20%. There’s a lot of debate here, and plenty of perspectives on how positive and negative market movements earned such visual mascots. The most commonly accepted reasons are simply nature and human history. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd.co/freestock.

Youre Our First Priority Every Time.

Enough “growth” investments that if the market continues to rise, I’ll offset the inexorable bleed of inflation and earn an acceptable rate of return. Having worked as a professional analyst and journalist during two of the bear markets Rosenberg describes — and having studied the “Great Crash of 1929” — I can confirm that these patterns are real. Many observers have been mystified by the stock market’s behavior since mid-March. Although the length varies, bear markets generally lasteight to nine months, according to CAN SLIM. Corrections usually last just few weeks or months. The bull market that started after the 2007 financial crisis is the longest in American history. The Dow Jones industrial average has quadruped during the historic run and the S&P 500 is up over 300%.

Think of a bear with its nose pointed down and claws scratching down. Daily market fluctuations may have more of an impact on your investments. The daily market ups and downs are most likely noise you may choose to ignore, but longer-term trends can affect your returns. The peak for the U.S. stock market before the financial crisis of 2007–2008 was on October 9, 2007. The S&P 500 Index closed at 1,565 and the NASDAQ at 2861.50.

When Were The Most Prolific Bull And Bear Market Periods In The United States?

For all the glory the tech giants are getting these days, the best performing stocks in the S&P 500 since March 23, through the Aug. 18 confirmation, are actually two energy sector names. Rounding out the top five, industrials have gained 58%, and energy is up 54% since the March market bottom. For what it’s worth, financials are lagging with a 40% gain.

- A contra market is one that tends to move against the trend of the broad market, or has a low or negative correlation to the broader market.

- A connection between bears and market conditions can be traced back to at least the early 18th century.

- There’s a trope about millennials being shaped by the 2008 global financial crisis in their formative years, pushing them away from financial risk-taking and taking on debt.

- Now as an advisor to the AdvisorShares Ranger Equity Bear ETF, Tice has spent much of his career making bearish bets during bull markets.

- The final phase is marked by excessive IPO activity, trading activity and speculation.

“But when it breaks, it’s likely to break hard and cause investors to suffer for a long time.” To be sure, some on Wall Street have varying views of what defines a bull or bear market but these are the most widely accepted definitions.

Investors should spend time making a watch list of stocks to buy when the market improves. During a bull market, investors should focus ongrowth stocksand follow CAN SLIM to select stocks and to time buying for maximum returns. Market conditions are typically described as either “bull” or “bear” depending on the long-term directional movement of the market. When prices are on the rise and investor sentiment is high, we’re experiencing a bull market. But when prices take a dip, typically 20% or more from recent highs, and investor confidence is generally low across the board, we may be looking at a bear market. Bull and bear markets trends are good indicators to buy or sell the stock it is advised to buy at the entrance of a bull market not in the bear market because you dont know when the bear period ends.

That generally means making your investments more conservative, or cash-, bond- and fixed-income-based, than you have before. Phil is a hedge fund manager and author of 3 New York Times best-selling investment books, Invested, Rule #1, and Payback Time. He was taught how to invest using Rule #1 strategy when he was a Grand Canyon river guide in the 80’s, after a tour group member shared his formula for successful investing. Phil has a passion educating others, and has given thousands of people the confidence to start investing and retire comfortably.

Charles Dow applied this method with his classic Dow Theory, stating that higher highs and higher lows describe an uptrend while lower highs and lower lows describe a downtrend . In addition, investors may benefit from taking a short position in a bear market and profiting from falling prices. There are several ways to achieve this including short selling, buying inverse exchange-traded funds , or buying put options. The key determinant of whether the market is bull or bear is not just the market’s knee-jerk reaction to a particular event, but how it’s performing over the long term.