Table of Contents

- Conditions For A Bear Trap

- Buying Stocks In A Bear Market

- What Is A Short Squeeze (bear Trap)?

- Is This A Classic ‘bear

- Stock Forecast Based On A Predictive Algorithm Contact Us:

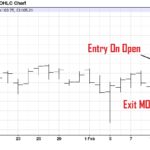

The blue lines indicate the divergence between the price and the two oscillators. The red line on the chart shows that the price is making lower lows, while at the same time the MACD and RSI are clearly moving upwards. This creates two bullish divergences between the price and the two indicators, despite the bearish breakout. This is a sign that a short position would not be a good move in this case. If you had shorted after the trend break or the triangle breakdown, you would have gotten yourself into a bear trap! Notice that the real stock moves occur during high volumes.

He was formerly a senior distressed debt trader at Lehman Brothers and was part of the team that made $2 billion betting against the U.S housing market. Along with actionable trade ideas, we provide clients with a timely, first-hand look at global political market moving events. Our teams on the ground in New York, Toronto, Washington, Puerto Rico, Brussels, Dublin, Rio and Beijing bring you closer to what is moving markets.

Conditions For A Bear Trap

The opposite of a bull trap is a bear trap, which occurs when sellers fail to press a decline below a breakdown level. A short seller risks maximizing the loss or triggering a margin call when the value of a security, index, or other financial instrument continues to rise. An investor can minimize damage from traps by placing stop losses when executing market orders. A bear trap can prompt a market participant to expect a decline in the value of a financial instrument, prompting the execution of a short position on the asset.

What are the hottest stocks right now?

Most ActivesCompanyPrice% ChangeWFC Wells Fargo & Co39.84+1.25%FCX Freeport-McMoRan Inc36.11+3.20%CCL Carnival Corp28.93+2.41%XOM Exxon Mobil Corp59.37+0.44%6 more rows

Not only should we look for a good trading opportunity, but we should also watch out for trading traps. We should differentiate between trading opportunities and trading traps, such as bear traps. That’s very important though, because there are many trading opportunities which don’t turn out to be as they appeared at first, instead they turn out to be false breakouts. Actually, this aspect of trading might be even more important, because if you don’t lose money then you will end up winning eventually. It is called a bear trap, because this chart pattern often lures traders into short positions only to quickly reverse to the upside. This is the 10-minute chart of Bank of America from Nov 12 – 16, 2015. The blue lines indicate a trading range, which BAC was stuck in for the majority of the day.

Buying Stocks In A Bear Market

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. There are many dangers inherently found when investing or trading in the equity markets. But what increases your risk is not knowing how to identify or avoid the many traps purposely set up to take your money. In this example, the security sells off and hits a new 52-week low before rebounding sharply on high volume and lifting into trendline resistance.

- After the support is put in place just below 0.84, EUR/GBP moves higher, but finds resistance at the 50 SMA .

- The “Bear Market Trap” is when investors get really excited and buy stocks thinking that the worst is over, only to find the market come crashing back down later delivering more losses.

- When you can spot short squeezes, you can make some pretty good money from the momentum.

- With all else equal, more money must continue to chase the largest stocks ad infinitum.

The answer is different for each of us and depends on our individual risk tolerance and time horizon. No one knows the future, so we should build our portfolio so that we will be and feel OK no matter what happens. I will also note, however, that moments of greatest fear and skepticism are often the best buying opportunities.

What Is A Short Squeeze (bear Trap)?

Calls were also out-trading puts roughly 17 to 1 in early trading. When we talk about avoiding losses in stock markets during the Coronavirus pandemic, there is no better way to minimize the risks than conducting your decision in a solid analysis. Stock holders only realize profits when they sell the shares, meaning that higher rates of acquisition also increase pressure to sell.

provides weekly insights, highlighting the impact of the political world onto the global financial markets, making specific investment calls. The report will give you a complete view of the global markets, where to spot opportunities, and how to avoid risk. The letter is unique and unbiased, unlike any other research on Wall Street. Our independent investment research stems from an elite team of analysts and strategists with real trading floor experience. Bear Traps was founded by Lawrence McDonald, he has spent 30 years working on Wall Street.

Is This A Classic ‘bear

In many ways, it’s the opposite of a “bear trap,” which can fool traders into selling out too soon in the midst of a bull market. A good example of a bear trap can be found on the chart below. As we can see, GBP/USD is trading on a bullish trend on the daily chart.

Ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis. I hope you found this informative, and if you would like to get a pre-market video every day before the opening bell, along with my trade alerts. These simple to follow ETF swing trades have our trading accounts sitting at new high water marks yet again this week, not many traders can say that this year. “Always intrigues me how many amateur surfers get to the north shore beaches in Hawaii, take one look at monster waves and conclude it’s way too dangerous. Yet the amateur trader looks at treacherous markets like these and wants to dive right in!!

Dont Get Caught In A bull Trap

After several attempts to break the support at 0.83, all of which are rejected, the break finally comes, or so it seems like. The support comes right at 0.83, which is another big round number and on top of that the candlestick even closes below it. But, the next candlestick takes the price right back up, above the support and then to surge higher for 300 pips, after the 50 SMA turns into support.

This signals to the institutions that it may be time to set the bear trap on the stock. When you see an increase of volume accompanying a breakout in price, a bear trap is usually not far off.

Stock Forecast Based On A Predictive Algorithm Contact Us:

These tools can help traders understand and predict whether the current price trend of a security is legitimate and sustainable. The AI-powered algorithm is responsible to generate daily stock market predictions that help investors to understand stock trends and to invest properly. By using machine learning and over 15 years of stock database, the algorithm provides outlooks for different stocks in different time horizons, for both short and long positions. All in all, the algorithm can help your investment strategy to avoid falling in traps. When a market reaches maximum bearish sentiment at a price level where traders and investors prefer to hold their positions instead of sell a bear trap could be set. The best way to stop bear traps when trading is to first off know candlestick patterns and support and resistance levels. Also, have mental stops in place before taking a trade, and stick to them.

As the SARS-COV-2 virus continues its westward migration from China to Europe to the U.S., public and private sectors worldwide have been working feverishly to control the damage. Yet, despite the best efforts of a host of highly qualified experts, this storm, which has yet to peak in the U.S., will certainly cause massive damage to the U.S. and global economy. Another way to avoid a bear trap will be to set the recent trend highs as the stop loss point and enter a short trade. The best way to avoid a bear trap is to have a firm exit criterion in place and set a tight stop loss.

Beware Of The Bear Trap

With that being said, we might be seeing a bull trap right now. There is still time that the U.S. and the rest of the world will be in lockdown and there is also a fear of a second wave of the outbreak to happen. The forecast of the economy returning to normal this year is not as realistic as the stock market is indicating. Right now, we are experiencing a different situation in the stock markets after a huge hit by the time the pandemic turned out to be worldwide.

If you’re holding good stocks but they’ve taken a beating, a wise course of action is to do nothing with them. Also make sure you have exposure to safe haven assets, many of which are back on the bargain shelf. Dividend-paying stocks of essential services companies are good bets. The International Monetary Fund warned last Friday that the coronavirus pandemic will trigger a global recession this year that could be worse than the one caused by the financial crisis of . The global economy already was slowing, due to factors such as the Sino-American trade war. The recent rebound in the stock market has been a welcome relief, but don’t abandon shelter. Look up bull trap in Wiktionary, the free dictionary.This business-related article is a stub.

The bullish abandoned baby is a type of candlestick pattern that is used by traders to signal a reversal of a downtrend. The Herrick Payoff Index tracks price, volume, and open interest to identify potential trends and reversals in futures and options contracts. However, when stocks are acquired, they automatically become selling pressure on that stock because investors only earn profits when they sell. Therefore, if too many people buy the stock, it will diminish the buying pressure and increase the potential selling pressure. U.S. stocks closed higher Wednesday, shrugging off earlier losses, after Federal Reserve policy makers said no interest rate hikes were expected through 2023, even if inflation overshoots 2%. Despite the Federal Reserve’s pledge to keep policy on hold, Treasury yields are rising, throwing risk assets into turmoil.