Table of Contents

- Get Unlimited Access To Investmentnewsstarting At $1 A Week For 4 Weeks

- Us Equity

- An Innovative Approach, Combining Defensive Equity Exposure And Outperformance Potential

- Strategies For Trading Volatility With Options

- Bearish Strategy No 1: Long Atm Put Vertical

In contrast, an active manager can favor stocks with higher expected returns. Therefore, though many portfolios will deliver similar levels of volatility reduction, they will offer very different levels of expected return. Factor investing is an investment strategy in which securities are chosen based on certain characteristics and attributes that may explain differences in returns. There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain factors. Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. Factor investing may underperform cap-weighted benchmarks and increase portfolio risk.

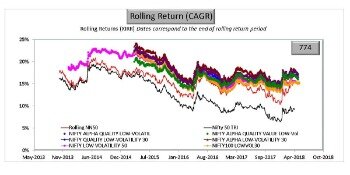

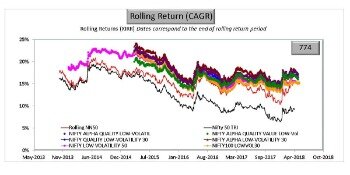

In addition, while the high costs of defensive positions are not properly accounted for in most passive low volatility strategies, active low volatility strategies can offer risk reduction or dividend income at reasonable valuations. Against the backdrop of rising volatility and expensive valuations for risk reduction, an active low volatility strategy that empowers investors to reduce risk at reasonable cost while maintaining equity upside for the long-term is imperative now more than ever. Performance figures contained herein are hypothetical, unaudited and prepared by Alpha Architect, LLC; hypothetical results are intended for illustrative purposes only. There is a risk of substantial loss associated with trading stocks, commodities, futures, options and other financial instruments. The authors break down their analysis into growth and slowdown macroeconomic phases and find that their strategy outperforms the benchmarks across the three regions regardless of growth or slowdown phase.

Get Unlimited Access To Investmentnewsstarting At $1 A Week For 4 Weeks

In fact, there are frequently sharp differences between hypothetical performance results and the actual performance results subsequently achieved by any particular trading program. 4The result is unchanged if the Pastor-Stambaugh liquidity factor, which has zero loading and no significance in these regressions, is added to the right-hand side. 1 In this paper, use of the past tense indicates a statement about historical facts.

We employ one process across five investment platforms, including our low volatility equity platform. Low volatility strategies can be an effective component of a diversified portfolio. The data show their value is most beneficial when the bear growls the longest. As fears turn into recession and eventual declines in earnings, low volatility stocks tend to outshine their sexier cyclical growth counterparts. But using them to hedge against volatility in the short-term has a mixed record at best. The abrupt, forced halt of economic activity was caused by a health care crisis and not by an overheating or slowdown of the economy.

Us Equity

Such portfolios are generally rebalanced on a regular schedule , to ensure that holdings can be adjusted as volatility changes. The “lottery effect.” Investors can treat stocks like a lottery ticket, seeking larger returns by buying relatively riskier stocks. This “lottery effect” bids up the price of riskier stocks and results in lower risk, out-of-favor stocks being systematically underpriced, which may translate into outperformance.

Investors are warming to the benefits of microcap, in particular its higher return potential paired with multiple benefits in an asset allocation framework. Even though FAANGs are revered as pillars of the U.S. stock market, there might be a better way to out-distance the broad-market index over the long term. We discuss how a strategic allocation to low volatility may help an investor achieve various outcomes and how it fits into a broader portfolio. There is no guarantee that any investment strategy will meet its objectives. Dividends are not guaranteed and are subject to change or elimination. The Russell 2000® Index measures the performance of the small-cap segment of the U.S. equity universe.

An Innovative Approach, Combining Defensive Equity Exposure And Outperformance Potential

Since the global financial crisis hit in 2008, low volatility has garnered increased attention from institutional investors. Low volatility has outperformed in only half of the last 14 years.Some proponents argue that low volatility portfolios are underappreciated because they stay off the headlines of the financial news. From 1970 onward, low volatility strategies have offered higher returns and lower volatility than the index, which leaves some investors asking why anyone would invest in high Beta stocks. The Capital Asset Pricing Model argues that a stock’s return should be proportionate to its systematic risk, or beta. Early empirical tests found that this formulation worked well for stocks with betas below 1.00, but not for higher beta stocks.

The implied volatility of this put was 53% on January 29, 2016, and it was offered at $11.40. This means that Netflix would have to decline by $12.55 or 14% from current levels before the put position becomes profitable. Based on this discussion, here are five options strategies used by traders to trade volatility, ranked in order of increasing complexity. To illustrate the concepts, we’ll use Netflix Inc options as examples. The most fundamental principle of investing is buying low and selling high, and trading options is no different. So option traders will typically sell options when implied volatility is high because this is akin to selling or “going short” on volatility.

Are ETFs more volatile than stocks?

Commodity ETFs can be more jumpy than stocks. But other ETFs track bond indexes. Those tend to be considerably less volatile (and less potentially rewarding) than stock ETFs. One ETF (ticker symbol SHY) tracks short-term Treasury bonds, and as such is only a little bit more volatile than a money market fund.

Butterfly spread is an options strategy combining bull and bear spreads, involving either four calls and/or puts, with fixed risk and capped profit. A calendar spread is a low-risk, directionally neutral options strategy that profits from the passage of time and/or an increase in implied volatility. A fence is a defensive options strategy that an investor deploys to protect an owned holding from a price decline, at the cost of potential profits. Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period.

Strategies For Trading Volatility With Options

Investors have come to question whether the time has come for the market, the economy or both to retrench. As a result, they have begun to rotate significant amounts of money into defensive strategies focusing on dividends, low risk sectors (e.g., utilities) or passive low volatility strategies. Our research suggests this has led to crowding and expensive valuations in these areas. Investors with shorter time horizons, liquidity needs or regulatory considerations, only reap the advantages of a low volatility investment when risk can be reduced before asset value decline. High-volatility stocks that are profitable and cheap (Quintile 4, value-profitability scores of 4 – 8) actually have positive benchmark-adjusted returns. Those that are expensive relative to their profitability actually underperform the market.

What is the best ETF for 2020?

Ten of the best-performing ETFs this year:Global X Lithium & Battery Tech ETF (LIT)

Renaissance IPO ETF (IPO)

Amplify Online Retail ETF (IBUY)

ARK Next Generation Internet ETF (ARKW)

ARK Innovation ETF (ARKK)

Invesco WilderHill Clean Energy ETF (PBW)

ARK Genomic Revolution ETF (ARKG)

Invesco Solar ETF (TAN)

More items•

The Dimensional study finds that low volatility strategies are correlated to value strategies which have a long history of robust outperformance. From , 28% of the low volatility index overlapped with this value factor. With lower fees and a stronger track record, we prefer value strategies over low volatility strategies for our clients. Dimensional Funds “Smart Beta” StudyIf you are going to try to beat the index, you need to find factors that are consistent across time and across markets. Eugene Fama, father of the Fama-French factor model, suggests that it takes 67 years’ worth of data points to even begin to feel confident that back-testing results are reasonable.

Please consult with your financial, tax, or other professional about how these state benefits, if any, may apply to your specific circumstances. You may also contact your state 529 plan or any other 529 education savings plan to learn more about their features.

However, protecting against market crashes are not what these strategies are designed to do. A low volatility equity strategy is still 100% invested with risk potentially mitigated, but not eliminated.

This second book furthers this aim by delving deeper into important investing principles without sacrificing simplicity, tackling issues such as retirement planning, long-term investing, and owning property. Specifically, they rank the 500 low-volatility stocks by both total yield and momentum and then buy the 100 stocks with the highest combined score. They also screen for momentum, which the research has shown helps to avoid what are called “value traps”—stocks that are cheap for a very good reason. Thus, they look for low-volatility stocks with high total dividend yield and positive momentum . Van Vliet and de Koning address this issue by noting that it’s not sufficient to look at low volatility. They explain that in managing Robeco’s Conservative Equity funds, they focus on buying low-volatility stocks that also have high-dividend yields and share buybacks . Note that, historically, low-volatility stocks are value stocks—stocks with low prices to metrics such as book-to-market and earnings.

Trading volatility therefore becomes a key set of strategies used by options traders. Options prices depend crucially on estimated future volatility of the underlying asset.

- Shares may trade at a premium or discount to their NAV in the secondary market.

- Dimensional Fund Advisors LP does not sponsor, endorse or sell, and makes no representation as to the advisability of investing in, John Hancock Multifactor ETFs.

- In 2020, however, when the market was down, the Low Risk 200 fell even more, and then continued to underperform in the subsequent market recovery.

- Since the Global Financial Crisis hit in 2008, low volatility has garnered increased attention from institutional investors.

- In this example, the value, size, and yield portfolios each outperformed the market.

- There will be relatively small performance differences between the Russell 1000 and S&P 500 as large cap proxies as well as the use of total returns versus price return declines as the drawdown measure.

Low-volatility investing is an investment style that buys stocks or securities with low volatility and avoids those with high volatility. According to financial theory risk and return should be positively related, however in practice this is not true.

Invesco Capital Management LLC, investment adviser and Invesco Distributors, Inc., ETF distributor are indirect, wholly owned subsidiaries of Invesco Ltd.

Most investors understand risks evolve over time, and factors and stocks that have not been historically risky can become risky very quickly as economic forces change. The low volatility anomaly is an observable phenomenon across market segments and regions. Low volatility indices have outperformed their capitalisation-weighted benchmarks over time with lower risk. Even more remarkably, without exception, low volatility indices exhibit a distinct pattern of returns when compared to their benchmarks. They all attenuate the performance of the broader market, losing less when markets decline and gaining less when markets rise. Because of this dynamic, low volatility indices are poised to take advantage of an important market characteristic; they outperform in periods of relatively high dispersion. Otherwise said, low volatility strategies tend to be right when the payoff for being right is most advantageous.

Please contact your financial professional or call to obtain a Plan Disclosure Document or prospectus for any of the underlying funds. ThePlan Disclosure Documentcontains complete details on investment objectives, risks, fees, charges, and expenses, as well as more information about municipal fund securities and the underlying investment companies that should be considered before investing. Please read the Plan Disclosure Document carefully prior to investing. The S&P 500 Low Volatility Index measures performance of the 100 least volatile stocks in the S&P 500. The index benchmarks low volatility or low variance strategies for the U.S. stock market. Constituents are weighted relative to the inverse of their corresponding volatility, with the least volatile stocks receiving the highest weights.