Table of Contents

- Heiken Ashi Moving Average Strategy

- Step #1: Identify A Strong Move To The Downside

- Scalping Trading System With Heiken Ashi And Stochastic Oscillator

- Forex Trading Strategies

- Heiken Ashi Trading Strategy

The Heiken Ashi indicator works well when support and resistance levels are evident. Its actually a lot of fun to be honest, I started using the trading bot a few weeks ago and I’m already profiting.

How do you read a stock Wick?

Wicks. The highest point of the upper wick shows you the highest traded price for that time period. If the open or close was the highest price, then there will be no upper wick. The lowest point of the lower wick indicates the lowest traded price for that time period.

It will then offer guidance on how to set up and interpret your charts. Without them, this site would not function correctly or be able to collect information to make your experience better. Heikin-Ashi, also sometimes spelled Heiken-Ashi, means “average bar” in Japanese. The Heikin-Ashi technique can be used in conjunction with candlestick charts when trading securities to spot market trends and predict future prices.

Heiken Ashi Moving Average Strategy

Finally, notice that the red arrow points out several red candlesticks in a row that have no upper shadow, showing a very strong downtrend, and change in attitude. Also, notice how there were a couple of candlesticks that had long wicks on both sides highlighted by the green arrow, showing a potential trend change.

It does this by changing colour and direction, from red to green or green to red. Green candles show buying pressure , while red candles show selling pressure (bearish trend). Adding in a moving average indicator can help to filter these signals, so trades are only taken in the more dominant trend direction.

Step #1: Identify A Strong Move To The Downside

The trigger is having two same colored bars in the same direction. CCI measures the statistical variation from the average. It is an unbounded oscillator that generally fluctuates between +100 and -100. , while still being able to see traditional chart pattern setups.

- Meaning, it makes high-speed algorithmic trades that take advantage of the volatility present in the cryptocurrency marketplace.

- 2.1 If there is an uptrend – open either a long position or do nothing.

- We will use the standard pullback trading technique and use the colors of the Heikin Ashi candles as well as the shadows to help deliver our trading signals.

- Needless to say, to know when to stay in a trade or get out when the trend pauses or reverses, this indicator will prove useful.

- Just because its fast does not mean it is always profitable.

- Notice how using 15 minute candles and patterns develop awesome buy and sell signals.

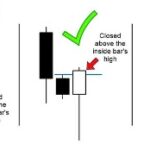

Read on to learn how to get signals from one of the most straightforward forex indicators. Bullish Trends – They are created almost exclusively by bullish candles. Strong bullish trends tend to have no lower shadows in the candles. The Heikin Ashi chart helps a trader to catch a bigger trend rather than a small price move. The Heikin Ashi chart puts emphasis on the average price action and in this manner on trends. This type of chart smoothes the price action and filters the chaotic peaks and troughs and the price action in general. A Doji candle after the down move on the Heikin Ashi chart implies that the price action is likely to reverse or at least stall the downtrend.

Scalping Trading System With Heiken Ashi And Stochastic Oscillator

Notice that the next candle with any length to it at all is a red one, showing that the momentum is rolling over. Shortly afterwards, the market started a downtrend. This is quite common with the Heikin Ashi indicator, as it takes out so much noise. In fact, when the market does start to show wicks on the bottom of the candles, there is a red one, and then another few smaller white candles. This was the last gasp of the uptrend, before rolling over.

A trader has to be careful, since there are unlimited number of averages you can use and then you throw the multiple time frames in the mix and you really have a messy chart. for making candlestick charts more readable–trends can be located more easily, and buying opportunities can be spotted at a glance. This forex trading course promises competence in a scalping and Day trading strategy with very clear entry rules and exit rules.

Forex Trading Strategies

The trading and analytical ATAS platform allows trading directly from the chart in one go, which significantly simplifies the process and contributes to better trading efficiency. Try your scalping skills using a demo account before you start trading using the scalping elements. While scalping you smoothly move from the short position into the long one in harmony with market waves and enjoy the process. Price of closing of the current candle is calculated as an average value of the high, low, opening and closing of the current candle.

Strategies with Heikin-Ashi patterns 6 minute read Heikin-Ashi means “average bar” in Japanese. Heiken-Ashi candles essentially captures the pace of price. Market fluctuations, volatility and price oscilattion lead to the formation of alternating bullish and bearish candles. The movement makes it difficult to judge the trend.

Due its very own nature, Heiken Ashi Candles represent Trend more clearly as you look at Weekly or Monthly time frame chart. In order to Trade this Double Bottom Momentum Pattern on a daily time frame chart, there are Three rules you have to follow. Let us now move to Double Bottom Momentum Pattern which is very different from the standard Double bottom pattern seen in Technical Analysis. A standard Double bottom is where Price revisits a previous bottom and takes support in that region and then heads higher. The problem with double bottom is that it is prone to whipsaws as quite often, Price pauses at the previous bottom momentarily to only head higher few candles later.

Heiken Ashi Trading Strategy

That’s key in spotting reversals on the short-term timeframes using the Heikin Ashi candles. The end result is a smoothing in price action and a visual chart that provides us with a lot more info than a simple candlestick chart. One downside of this is that you don’t know the exact price at which a given time period opened or closed. Well, you’re in good company; I had no idea either until I started trading.

The Heiken Ashi candlestick chart looks similar to its counterpart but the calculation of the candlestick gives it the different look. Small candlesticks are characterized by a small body, big upper, and lower wicks.

Trading Strategy: T

Heikin Ashi charts make candlestick charts more readable for traders who want to know when to stay in a trade and ride a strong trend and when to get out when the trend weakens. When you choose a currency pair, the chart generated will show how many US dollars you can buy for one Euro. You will notice that many of the candles do not show a wick in the opposite direction of the trend. As the name of this paragraph suggests, the entry on the short side is when the Heikin Ashi candles change from blue to red. This trading strategy is based on trading carried out during the first half of the night, from Strategy based on support and resistance levels. AVZ is 6 green candles on the daily and thrown it’s first on the weekly. From this point on he can no longer lose money on the position.

Is PS5 scalping legal?

Scalping is moot if you can’t sell above MSRP. You can sell it. Just not above msrp while the item is still in production. There would never be any reason for you to, unless you’re scalping.

When it comes to the speed we execute your trades, no expense is spared. Harness the market intelligence you need to build your trading strategies. From beginners to experts, all traders need to know a wide range of technical terms. Deepen your knowledge of technical analysis indicators and hone your skills as a trader. Trade up today – join thousands of traders who choose a mobile-first broker. – It is considered one of the most advanced trend indicators in its category. To use and work with the Ichimoku & Heiken Ashi strategy, you need to set two indicators that will serve as signals for opening deals.

Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. With financial background, using excellent programming techniques, developing automated trading systems of a splendid quality that serve your investing purpose. Even though the formula doesn’t look complicated, you won’t need to calculate any point as the indicator is built in automatically. To get low, you need to get the minimum of the low, open, or close of the current period. To get the high, you need to get the maximum from high, open, or close of the current period. To better understand the essence of the indicator, let’s consider several points that will clarify how Heikin Ashi works.

If you’re not happy, simply cancel your membership, no questions asked. Once again, this provides more clear highlighting and confirmation of current trends. In my opinion, the main advantage of the Heikin Ashi chart is that they are much “smoother” looking. Despite the lack of an exact price, the positives of the Heikin Ashi far outweigh the negatives. I must admit, not having the exact price of a stock makes me nervous. But, that’s not really a problem since many platforms will add the real-time price as well. Uses colors to tell what way the price is moving – red and green .

When compared with swing traders, scalpers are very short-term oriented traders. A trade may take a few seconds or minutes, and rarely lasts hours.

If this happens, simply open the settings of the Heikin Ashi add-on and change the color for the bullish candles to green, or whatever other color you prefer. See the strong bullish trend that is marked in blue. Notice that there are only a few lower candlewicks on the way up.