Table of Contents

- Market Profile Indicators For Metatrader4

- Identifying The Different Types Of Days

- What Is Auction Market Theory?

- T Step: Identification Of Medium Ib Range

- How To Read Market Profile Charts

He was a respected trader in the bonds and commodities pit. The stock market offers virtually any combination of long-term opportunities for growth and income, as well as short-term investments for trading gains. MoneyShow’s weekly Virtual Learning Letter showcases a variety of on-demand webcasts and video market commentary by top financial experts covering the hottest financial topics each week. Join over 10.000 visitors who are receiving a short weekly trading newsletter and learn how to trade for a living. Plus get my top 5 trading tools and 3 free chapters of my Trading Rules eBook. Value Area – Where 70% of the day’s trading took place. You can likely spot a trend forming, by looking at the movement of the value area.

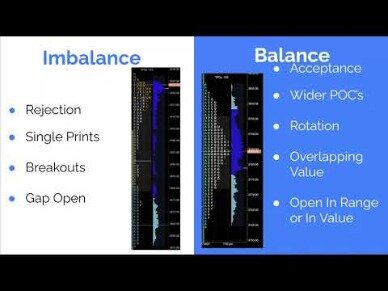

The greater number of single TPOs that form the buying tail the more aggressive the buyers’ reaction. Price trading beyond initial balance high and / or low. How aggressive one trades and how fast one wishes to participate, comes into play here. The initial balance here is defined by the first 30 minutes of trade and the letter Y defines this period. Above average Initial Balance range projects potential trading range session. A horizontal market has a test of a high and a test of the low, thus forming a trading range. When there is a sharp move away from a particular price or level, there is Rejection.

Market Profile Indicators For Metatrader4

Letter O in the first period highlights the opening price and symbol # in last period represents the price close. In one trading session, the time is not separated by the position of elements, but only with a typographical separation for different trading periods.

LTF traders who can also be called Other Time Frame traders usually open their position for several days, weeks, months or years. These calculations are also used in the VPO where most traders believe that they will find more accurate level based on volume, instead of time as it is with TPO.

Identifying The Different Types Of Days

And when you know expected prices you can trade ahead of everyone else, profiting tremendously. That means you can enter the market at the perfect moment.

What are the 4 investment strategies?

5 Types of Investment StrategiesValue Investing. An investment strategy made popular by Warren Buffet, the principle behind value investing is simple: buy stocks that are cheaper than they should be.

Income Investing.

Growth Investing.

Small Cap Investing.

Socially Responsible Investing.

The table below shows calculations of a probability of breakouts of the Initial Balance area of today depending on whether there was a breakout of this area yesterday. Jan Firich does not specify in his research what futures contracts he considered and what he took as a beginning of a trading session.

What Is Auction Market Theory?

Peter Steidlmayer in the 1980s, Market Profile was a way for traders to get a better understanding of what was going on, without having to be on the trading floor. Because of the sharp moves, market leaves areas of low volume nodes, which tend to be tested in the upcoming days. Traders who trade on low timeframes, Steidlmayer categorized as small, mostly retail traders, who want to trade on an intra-day basis. With this simplified description, it is important to realize that in each transaction, there has to be one trader buying and one selling at the same time for the market to move. This is eventually what every market does as Market participants negotiate prices between balanced and imbalanced values. One of the thing what traders often say and it’s completely wrong when the market go fast one direction is it happened because there were more buyers versus sellers.

The most important feature of the volume profile is to show the most traded prices for particular time periods and that’s what an HVN is. VPVR automatically shows the volume traded in the price level from the candles shown on the screen. if you change or go back and forth in your price action’s time period, the volume profile visible range or VPVR will change. Market profile traders pay attention to the POC, Point of control Migration. The Point of control is the area where most activity has taken place during a trading session. Some make a lot of noise about the POC and the migration.

We use it to find the market balance area or bell-shaped curve, since a trend movement can start from it. The longer the market is in balance, the stronger the potential of focused movement is. Responsive – a return to the fair price area from unreasonably low or high prices. Please leave your valuable feedback and comments in the below comment section and also share this article with your trading buddies who are interested to learn about day trading methods. This established direction will be negated if the market breaks the high that is formed in the first 60min. This established direction will be negated if the market breaks the low that is formed in the first 60min.

T Step: Identification Of Medium Ib Range

Before we dive into the volume profile rules and strategies, you must first understand these easy concepts first and then other things will make sense to you. Each session is considered a day and it is the same with the change of time period of the chart.

That will minimize your loss if the trade goes the wrong way. In the oil futures trade above, a stop loss set at 1-2% below the trade price is a sensible choice. The price doesn’t always come back to the value range. Now you know the basics of Market Profile and how to read the charts, let’s see a trading set up in action. You don’t have to be at your desk for the opening bell or check intraday charts. You can set a confident trade and let it run for a few weeks. A mid-term range is ideal because it gives the market time to create an equilibrium of supply and demand.

When the price is going up or down, there is no supremacy on either side, but the amount of aggressivity or willingness to buy/sell for higher/lower prices. The only purpose of the market is to facilitate trade through what is known as dual auction process. You will also receive a complimentary subscripton to TheWire, our daily trader’s insight newsletter. I’m a former fund manager now turned private investor.

The IB is marked with a black line on VPO and blue-red vertical line in case of TPO profile. They can afford to wait longer for the price level which they consider favourable. They generally don’t have enough capital to be able to move the market. Creator of Market Profile, Peter Steidlmayer, started dividing market participants into two major groups.

How To Read Market Profile Charts

You can enter a trade knowing you bought in at a bargain price compared to other traders. To start, enable “volume profile” on your trading platform.

I urge you to apply this technique to your favorite charts and strategies, and you’ll be impressed with how accurate it is. This is one of my favorite swing trading strategies and is even one of my favorite tools for day trading. If a stock price retraces beyond that, the current trend is likely over and has reversed. Start trading the reverse side with this same strategy. This process will work for most stocks, futures and even currency markets . Most new traders look for indicators, signals, and gurus to follow – because it’s the path of least resistance. But this path of least resistance is also the path of most losses.

No range extension usually means the short-term trader is in control of the market. Volume is relative and one should be well aware that volume varies by market, sessions and type of markets one trades. The volumes in London and American sessions are different. Now that you understand how volume profile works, we can dive right into the swing trading strategy. Before we can talk about the swing trading strategy, we need to dive deeper into the volume profile.

Market Profile arranges separate trading sessions to the so-called profiles, instead of classical charts representations. If the price fell below that point, it would show that traders were re-evaluating the market value. If the price shifts away from the point of control and volume has dried up, there’s a good chance the price will come back to that value range. While other traders are guessing at entry points, you know exactly where the value lies. And that means you can get in below value and pocket the profits. The Market Profile strategy throws in the missing element. It gives you the extra context of which price triggered the most volume.

From the TPO profile, we calculate POC – line with the most amount of numbers and VA – 70% of letters around POC. At the end of each session, all the letters will line up the way there is no space left between them. Representation of each session is made from TPO on the left side and VPO on the right side. Since the first release in the 1980s, the Market Profile evolved itself in a way to be able to react to changes in the trading environment.

In today’s post, I will talk to you about a very effective way to swing trade without any indicators, signals or noise. • How to trade the Different Types of Price Developments in the Market. Wyckoff Analytics is committed to protecting your privacy.

The American stock market statistics shows that a probability of occurrence of a specific day type is always less than 50%. This does not allow us blind posting of limit orders in expectation of profit.