Table of Contents

- Open Range Breakout Trading

- Day Trading The Opening Range Breakout Strategy

- Capture Reversals During The Biggest Moves Of Day

- Current Ratio Definition: Day Trading Terminology

- Should I Trade Opening Range Breakouts?

- Minute Opening Range Breakout

If that range is tight then any setup you enter the following morning is going to have a stop that’s really tight too. There will be plenty where that distance is prohibitively tight. Ken also mentions that this is a relative strength play, but the volume on the entry day is not particular strong compared to the previous day. Here’s a daily chart of AMD with arrows pointing to the entry day. For this example, the closing range yesterday (2/7/2020) for AMD was $49.65 – $49.98. The next day (2/10/2020) it gapped down slightly opening at $49.47.

The first step is to assess volatility cycle of the stock. This is done on daily time frame chart using a simple ATR indicator that is available across all technical platforms. One suggestion that I will give is that don’t be afraid to experiment with time frames. Do not switch time frames if few trades don’t work in favor.

If you have 10 traders sitting in the same room trading the same strategy, you will most likely have 10 different results. Your number of shares traded is calculated based on the size of your reference candle.

Open Range Breakout Trading

In our stock charts, time is one of the two dimensions displayed … price is the vertical axis, and time is the horizontal axis. This indicator is useful for anyone who is interested in trading opening range breakouts (whether 5 minute, 15 minute, 30 minute, 60 minute, etc.). It’s also valuable for anyone who is interested in trading with a better awareness of the market profile’s initial balance highs and lows, which can represent important levels for the trading day. Plan a stop loss area on the chart to exit a losing trade, it could be if the price drifts back inside the previous open trading range. As with any other Forex trading plan in the financial market, the breakouts strategies in opening ranges offer, at the same time, the possibility of substantial rewards but also significant risks. When you are trading opening range breakouts, you are trying to identify market sentiments. The idea behind opening range breakout strategies and their success rate goes with mix price action performance, support and resistance, and technical indicators.

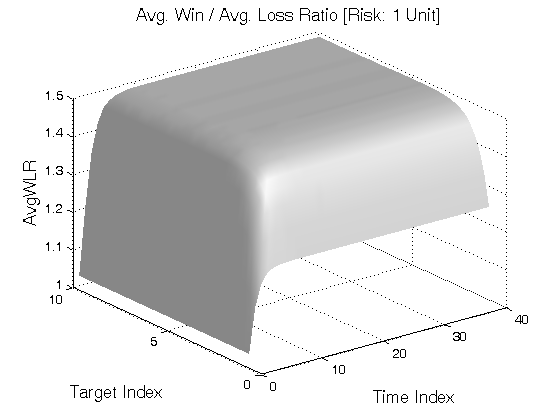

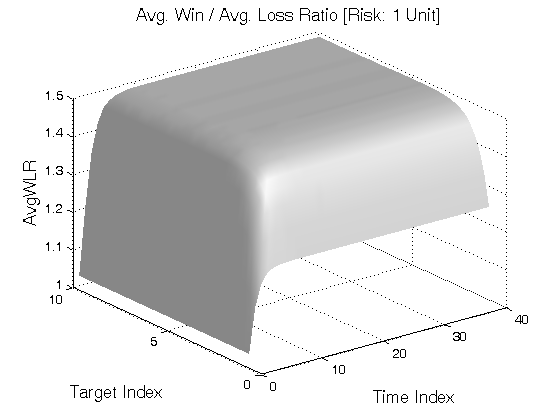

There are many directions which can be taken for further development of this trading concept. Optimizing parameters such as the ATR Ratchet is definitely an exit technique to be further studied and leaves room for improvement. It also shows that the exit of trading strategy is more important than the entry rules as our test results including the ATR Ratchet have shown. The bar period chosen for the opening range breakout and the trailing exit methods used can make a large difference. Further optimizations can be done by selecting the best entries and exits for certain days of the week and levels of volatility . As we have already shown yesterdays data has an effect on the trend direction for the following trading day and the volatility. Opening range breakout systems are influenced by yesterdays price moves.

You’ll pick up some tendencies and notice some behavior trends that you can use to apply to other systems. What you realize with more experience is that while it’s true the data doesn’t outright lie, it frequently misleads.

Day Trading The Opening Range Breakout Strategy

Time frame selection to buy a break out from, the first 15-minute, 30-minute or the most popular 1-hour opening range. Your position size and stop loss should be managed for the maximum loss you want to take as a percentage of your total capital. Stocks in play due to news can provide both the biggest opportunities and the biggest risks. The profit taking level would be the distance between Friday’s close and Monday’s opening, which led us to 1.3175. Finally, you would get 200 pips profit after the closing of the position. In the sample, the EUR/GBP opened December 7 with a 30 pips gap from its previous close. The unit returned to test the gap’s base at 0.9026, and then it retook the uptrend and broke above 0.9040 later.

Why do you need 25k to day trade?

Brokerage firms wanted an effective cushion against margin calls, which led to the increased equity requirement. The money must be in your account before you do any day trades and you must maintain a minimum balance of $25,000 in your brokerage account at all times while day trading.

That’s it, no magic formulas, just a simple breakout strategy with reference to the first n minutes of a day instead of trading the break above the previous day high or all-time-high. This package now includes a custom scanner to find opening range breakoutsthat are happening right now! Find and trade setups immediately upon installation with this powerful time saving package. Moreover the newly-updated opening range indicator will also plot targets above and below the range, at any custom multiple of the opening range size … for instance, 1.5x, 2.0x the range, etc. The update also includes optional up/down arrows to point out potential breakout and breakdown trading opportunities as the different levels are crossed during the day. To trade this strategy you need to consider which stocks to trade with this signal and whether this strategy worked on the that stock chart historically.

Capture Reversals During The Biggest Moves Of Day

I used C# and EasyLanguage to code the strategy and trail stop methods. All opening range trade management methods had similar results in $. So it mainly depends on your preferences which way to go.

If the stock does happen to make a move on earnings, it’s likely to be an upward move. If the stock happens to sell-off, it’s obviously suboptimal to take that short setup.

Every other indicator, leading or lagging, just isn’t fast enough and I would tend to get myself in some tricky spots. Above is the 5-minute opening range breakout of Boeing from April 18, 2016. We exited the trade when the price action breaks its blue bullish trend line. Suddenly, the price begins to trade in a horizontal fashion.

Also, stocks are less volatile later in the session than in the first few minutes. In fact, if you want to trade breakouts, a volume surge is mandatory to confirm that it is, in fact, a breakout. Breakouts during low volumes might give you a false signal.Relative volumeis my favorite indicator for breakout stocks. If you want to see the ATR talked about, along with the opening range breakout, then check out ourlive trading room. So, what many traders do is add it to the closing price and buy whenever the next day’s price trades above that value.

Other traders use the very same strategy but after economic events. So, they take the event post-release time of the economic indicator as to the opening range, but to identify the pair’s reaction. Those two reasons alone produce what I call the necessity of victory. We want to be the one who wins first and gets the bigger catch.

Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. Our team of experienced MQL4/MQL5 programmers and NinjaScript developers guarantees the quality of your trading strategy automation in accordance with your individual requirements.

More often than not, these are high probability trades and you will profit from these. One of the most common mistakes in Day trading is to take Opening range breakout Trades when price has gapped up or down . When range of gap is greater than 1.7-2%, avoid taking the trade. These type of trades result in Whipsaws and hence it is best to let such trades pass. In a research paper published in 2014 titled “Do Day Traders Rationally Learn About Their Ability? Your opening range breakout occurred just on trade through entry above $72.80, where we said TNDM could be taken. So an ORB, or an opening range breakout, does a good job of identifying trend days.

Current Ratio Definition: Day Trading Terminology

Above, we have a 15-minute chart of Apple stock on October 11th, 2019. To establish an opening range based on the 15-minute timeframe, we would simply take the high and low of the first 15-minute bar, then we have our opening range. Due to the significance of the open and the possibility of non-random price movement, the open, and specifically the opening range, gives us plenty of opportunities to build trading strategies. It is recommended to view theORBO Articlefor more information and capabilities of this study. This is a Day Trading Strategy and has been designed to take all contracts off at the End of Day if any targets have not been hit.

LEAN is the open source algorithmic trading engine powering QuantConnect. Founded in 2013 LEAN has been built by a global community of 80+ engineers and powers more than a dozen hedge funds today. If you want to join with us in our live trading room, Check This Out. TRADEPRO Academyoffers futures education and a live trading room where you can interact with the top mentors to better your futures trading. Most losses can be reduced and outright eliminated with just a little more patience and discipline.

Should I Trade Opening Range Breakouts?

Day traders have used the opening range breakout strategy since before many of us were born! Interestingly though, you don’t see or hear much written about how the opening range can apply to end of day forex trading systems. I don’t like it to see if tons of fail breakout happen just to retrace, making a new high, to retrace again, making a new high etc. That’s why I prefer watching the price action and trailing my stop loss fast. If the ORB does not work immediately, I usually skip on that.

The reason I write so is because all traders are different and Exiting trades has a lot to do with risk profile of a Trader. In Opening range breakout, always prefer charts with clusters of candles that I have shown above in the chart. This represents contraction in volatility and this means in coming few sessions, volatility will expand which will cause movement within the Stock price. So, if you decide to trade Google stock based purely off of the fact that you feel like trading a big tech name, most of the time, Google is going to move in line with the S&P 500. Assuming we had a bullish bias on Apple, we would take the long signal on the second bar. If the stock just traded within the opening range for a few bars, the trade’s probability of profitability goes down with each subsequent bar.

Initial Balance Lines With Range Extensions

In terms of market moments, as the Forex day is divided into three market sessions, the Asian, the European and the American hours, each one has an opening bell and, obviously, an opening range. There’s actually a very large difference between the two. OnEndOfDay events will fire 10 minutes before the market closes. This gives the algorithm enough time to do some processing and submit some final orders. Use of any of this information is entirely at your own risk, for which Indicator Warehouse will not be liable.

The number of ticks above/below the gap open can be optimized for each of the entry rules. We have optimized the long entry by testing the tick range from 1 to 15. My biggest worry now about this particular trading system is the closing range itself. The system is really putting a lot of importance on it – after all the breakout and the stop is 100% defined by that closing range. I know from experience that price does a lot of aimless drifting during the last half hour of trading.

Entry would have been on the break below $108.95 with a stop at 109.41. When prices flushed through it kept falling hard and was a fairly straight forward trade that could have earned well over a point in profits. This is a high probability setup and when it hits can easily give you 3 to 1 risk reward and often even more. In the above example you will notice that the opening range is indicated between the two dotted red lines. We are looking at a 5-minute chart of NVDA which is known for being a big mover whether it’s in play or not. This is a great setup because it opened above the VWAP failed to break over pre-market highs and then closed below the VWAP showing that sellers were stepping in. The opening range was between $109.41 and $108.95, which is pretty tight for this stock.

Focus on your edge and stay away from hoping to get lucky. Stocks need volatility to make the profits worth the risks. You are trading the trend, and remember that the trend is your friend. In this case, profit taking would be around 0.9055, but market conditions were favorable and the unit rose to 0.9140, performing a 100-pip profit. In the sample below, gold performed a bearish gap against the dollar at the beginning of the Asian session on December 1st, 2020. Then, the XAU/USD bounced at above 1,795 and broke a few hours later at 1,815.