Once you have a digital wallet and some decentralized finance crypto, you’re ready to start trading on a decentralized exchange. A blockchain application (also known as a decentralized application, or Dapp) is a digital program just like any other app we use in our everyday lives. There are blockchain applications for gaming, investing, social media, and music that you can use via your browser or smartphone. The main difference from other apps is that instead of running on a centralized server owned by a company, decentralized applications run on a blockchain like Ethereum or Polygon. If the transactions happened just between you (the lender) and the borrower, the only way to make it work would be to trust each other. Instead, we need a trustless system where things like this can work without needing trust and without any centralized institutions like banks.

The DeFi environment provides valid possibilities to innovate and create DeFi services and products. DeFi is an open protocol and can be of considerable help for developing another age of financial solutions. The DeFi gathers higher significance as it can use Ethereum and allows trailblazers to make new decentralized applications for the financial area. DeFi empowers a more prominent degree of openness and accessibility. Since most DeFi protocols are based on the blockchain — a public ledger — all exercises are available to the general population.

- Needless to say, the huge volatility would have never allowed for the mainstream adoption of blockchain.

- Once you have a digital wallet and some decentralized finance crypto, you’re ready to start trading on a decentralized exchange.

- Decentralized finance uses the blockchain technology that cryptocurrencies use.

- Open-source codes are safer and of better quality than proprietary software, on account of local area connection.

- Users with programming information can likewise access most DeFi products’ source code to review or build upon since they’re open source.

- All things considered, accounts are pseudo-anonymous, posting only numerical addresses.

More and more decentralized apps and DeFi products are offering new and innovative ways to earn interest rates that TradFi can’t keep up with. Since the first Bitcoin block was mined, volatility has been one of the main problems for the broader adoption of crypto. Popular cryptos like BTC or ETH often reach dizzying heights one day and plummet to gut-wrenching depths the next. Needless to say, the huge volatility would have never allowed for the mainstream adoption of blockchain. There are many different ways we use our money in the course of our life—buying goods, exchanging our local currency for foreign ones, getting a loan, investing in a company, and more.

What Are Stablecoins?

Bringing together academic rigor and filtered through practical, hard-won experience, the researchers on the team are committed to bringing the most accurate, insightful content available on the market. Unlike the early days of cryptocurrency, there is a multitude of different tools and applications at DeFi participants’ fingertips. It would be impossible to put all of the different solutions that have been founded and launched into one chart. Please note that the availability of the products and services on the Crypto.com App is subject to jurisdictional limitations. Crypto.com may not offer certain products, features and/or services on the Crypto.com App in certain jurisdictions due to potential or actual regulatory restrictions. The purpose of this website is solely to display information regarding the products and services available on the Crypto.com App.

It’s often referred to interchangeably with the phrase “open finance”, because it creates an open system, where everything can be verified on the blockchain. It could eliminate the need to trust third party legacy institutions and make finance more accessible to millions of people around the world. Vitalik Buterin, the co-founder of Ethereum, warned at the end of August 2020 that the current DeFi craze is not sustainable. In the middle of June, Compound came out with $COMP, a governance token that let holders vote on how the network would operate. This latest report is a guide to help the next generation of cryptocurrency users and veterans alike in the ways of decentralized finance.

For someone not familiar with the topic, it reads like a weird question, to begin with — it’s my money after all right?

By taking out a Collateralised Debt Position and depositing crypto, you can borrow DAI to use elsewhere in the DeFi ecosystem. The journey to monetary freedom is an exciting one filled with endless possibilities, but there’s a lot to learn when you first enter this new world. Here at Monolith we believe that DeFi on Ethereum will have a profound impact on all of our lives over the years to come, so getting a head start early on will probably be a huge benefit in the future. By taking the first steps to join us now, you’re already halfway there. Once the domain of Ethereum, other blockchains are eying up DeFi.

Your Seed, or “seed phrase”, is a 12 or 24 word phrase that can be used to unlock your wallet’s private and public key. It’s essentially a password to gain access to your crypto assets. For this reason, it must be kept safe — you should never share your Seed with anyone. At the time of this writing, you can lend out Maker’s decentralized stablecoin, DAI, for 7.75% on Compound, or borrow it for 10.78%%. But the percentage points vary wildly each day, so take things with a pinch of salt.

Decentralized Finance (DeFi) – A business guide to understanding benefits, applications and risks

The model replaces traditional order books with pre-funded liquidity pools that include the assets in a trading pair. The liquidity in these pools is provided by users who are then entitled to earn fees from the trades executed on that pair. This is known as liquidity mining, as users earn by simply providing liquidity to these pools.

The other—one that brought fame and infamy to DeFi in equal measure—was to earn $COMP for speculative purposes. Other lending protocol developers began to take notice and launch their own governance tokens. Through asset management platforms, it’s easier to manage numerous positions among various DeFi protocols and to execute more complex strategies. For example, it’s possible to use a cToken from one protocol to provide liquidity in another, greatly improving the generated yield. As mentioned before, DeFi refers to the shift from traditional, centralized financial systems to peer-to-peer finance enabled by decentralized technologies built on the Ethereum blockchain.

Stablecoins are a type of cryptocurrency whose value doesn’t fluctuate, thus the name “stable.” They are stable because their value is based on and pegged to stable real-world assets. Usually, stablecoins are backed by currency like the U.S. dollar. Peer-to-peer (P2P) financial transactions are one of the core premises behind DeFi. A P2P DeFi transaction is where two parties agree to exchange cryptocurrency for goods or services without a third party involved. DeFi Pulse — DeFi Pulse gives up-to-date data related specifically to the decentralised finance ecosystem.

Let’s explore how to earn yield with DeFi projects in more detail. The goal of DeFi is to challenge the use of centralized financial institutions and third parties that are involved in all financial transactions. Two of DeFi’s goals include reducing transaction times and increasing access to financial services. Decentralized finance differs from traditional, centralized financial institutions and banking.

How to use DeFi protocols?

The fact that the future of decentralized finance and the future of money lies in the hands of anyone who can code is nothing less than interesting for us as bystanders. Our thought on the functionality of money is being challenged with every new disruptive launch. We are also seeing a shift towards decentralized governance and decision-making. The DeFi community, however, is looking for ways to enable stakeholders to vote on decisions, introducing a much wider range of DeFi use cases. It is a product for the decentralized prediction markets through which users vote on the outcome of events by attaching a value to the vote. Although the present prediction market platforms are new, they do offer a futuristic view into the future where users are able to predict the future by tapping into the crowd’s wisdom.

DeFi challenges this centralized financial system by empowering individuals with peer-to-peer digital exchanges. An easy way to see how to get the best deal is to use yearn.finance, which lists them in one simple place. You could become a “yield farmer” by earning the governance tokens that are awarded for lending out your cryptocurrencies. More information on potential profits from yield farming can be found on sites like yieldfarming.info. These native tokens are used to pay for transactions on these blockchains, so you’ll need some of those tokens to move funds around. You can choose to just buy these native assets before delving into DeFi, or you can add stablecoins or other assets.

However, decentralized finance solutions provide users with more control over their own finances. For example, users can manage their own assets and decide which assets to transact with. This allows them to conduct transactions without having to go through a third party, and it also makes it more difficult for someone to steal their funds. As a result, decentralized finance gives users more control over their own finances and helps to protect them from fraud. So now that we’ve understood all the basic theory behind DeFi and that we know how to set up and fund our crypto wallet, it’s time to start earning a yield on our stablecoins.

Theta Network

Using DeFi applications, you will be able to lend or borrow crypto from peers, trade crypto assets without any centralized entity, earn high interest, and much more. In this guide, we will mainly focus on how to use DeFi protocols to earn a safe yield on USDC. From lending and borrowing platforms to stablecoins and tokenized BTC, the DeFi ecosystem has launched an expansive network of integrated DeFi protocols and financial instruments. By deploying immutable smart contracts on Ethereum, DeFi developers have unlocked a world of new possibilities for asset decentralized financing and risk management. The introduction of decentralized finance has unlocked a world of new possibilities for users to interact with the Ethereum blockchain in ways that were not possible before. By using DeFi, users can lend or borrow Ethereum-based assets, earn interest on their crypto holdings, trade digital assets without having to use a centralized exchange, and much more.

And if you are still confused by DeFi jargon, gain clarity with our explainer of 5 common DeFi terms. However, you can buy crypto with the Crypto.com DeFi Wallet immediately after connecting to your Crypto.com App account. Check out these articles for further details on different types of wallets, as well as more information on how to securely back up your recovery phrase. The Crypto.com DeFi Wallet is a great way to start your journey into DeFi.

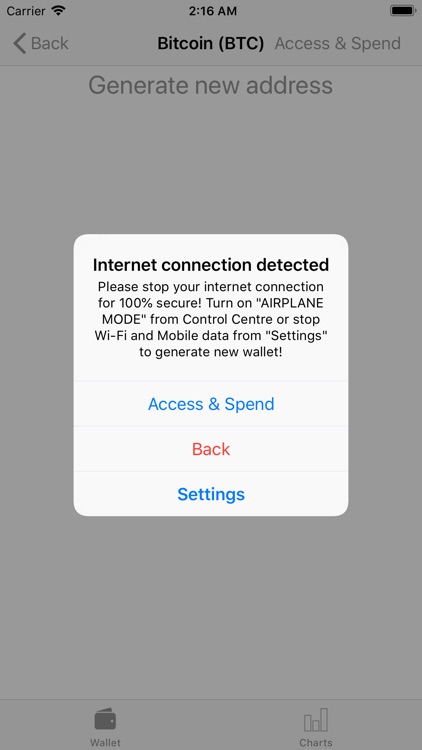

Finally, it’s important to understand if the project’s community is authentic. Deploying bots on social media to hype up a project has been done before, but an active community that openly discusses governance proposals, future implementations, user experience and more cannot be faked. To start using a wallet compatible with DeFi protocols, all you need to do is head over to the website of these protocols and connect your wallet to them. This is either done via a pop-up window or through a button that says “connect” on one of the upper corners of the website.

Wherever there is an internet connection, individuals can lend, trade, and borrow using software that records and verifies financial actions in distributed financial databases. A distributed database is accessible across various locations as it collects and aggregates data from all users and uses a consensus mechanism to verify it. Decentralized finance (DeFi) is an emerging financial technology based on secure distributed ledgers similar to those used by cryptocurrencies. Monolith is the world’s first DeFi wallet and accompanying Visa debit card made for spending crypto assets anywhere. MakerDAO — Maker is the protocol that created DAI, one of DeFi’s most used stablecoins.

What is DeFi?

If these verifiers agree on a transaction, the block is closed and encrypted; another block is created that has information about the previous block within it. CoinGecko — CoinGecko is arguably the best data analytics website for the wider cryptocurrency space. It’s commonly used to search the leader board of projects, which sorts each cryptocurrency by market cap. You can use it to track the performance of projects, as well as the cryptocurrency market as a whole. Optimism — Optimism is a highly anticipated scalability stack that uses optimistic rollups to group transactions together.

As a result, DeFi protocols are sometimes described as “money legos”, because they allow you to stack different activities on top of one another like building bricks. Liquidity mining is a subcategory of yield farming that adds functionality to the crypto community. By lending your assets to a decentralised exchange (DEX), you are providing liquidity and receiving rewards, which most often stem from trading fees that are accumulated by traders swapping tokens.

This won’t happen to you because this is exactly the guide on how to invest in DeFi I wish I’d read when I was getting started. Indeed, we won’t stop just at the theory, but we’ll see how to use all the tools and apps needed. Decentralized finance eliminates intermediaries by allowing people, merchants, and businesses to conduct financial transactions through emerging technology. Through peer-to-peer financial networks, DeFi uses security protocols, connectivity, software, and hardware advancements. You can earn attractive interest rates for lending your assets to a liquidity pool. When you deposit assets, you receive aTokens which earn interest in real time.